While service quality is the main driver of Americans’ tipping decisions, about three-in-ten U.S. adults also cite workers’ pay before tips as a major factor they consider, according to a recent Pew Research Center survey. But just how much that is can vary widely, because of the interplay of state and federal rules on minimum wages and tips.

As a supplement to our recent survey on tipping culture, we wanted to get a sense of how rules around pay for tipped employees vary throughout the United States.

Our primary source for this analysis was the Wage and Hour Division of the U.S. Labor Department, which enforces the Fair Labor Standards Act and other federal labor laws. We also consulted labor departments in states, such as New York and Oregon, where minimum wage rates vary by location.

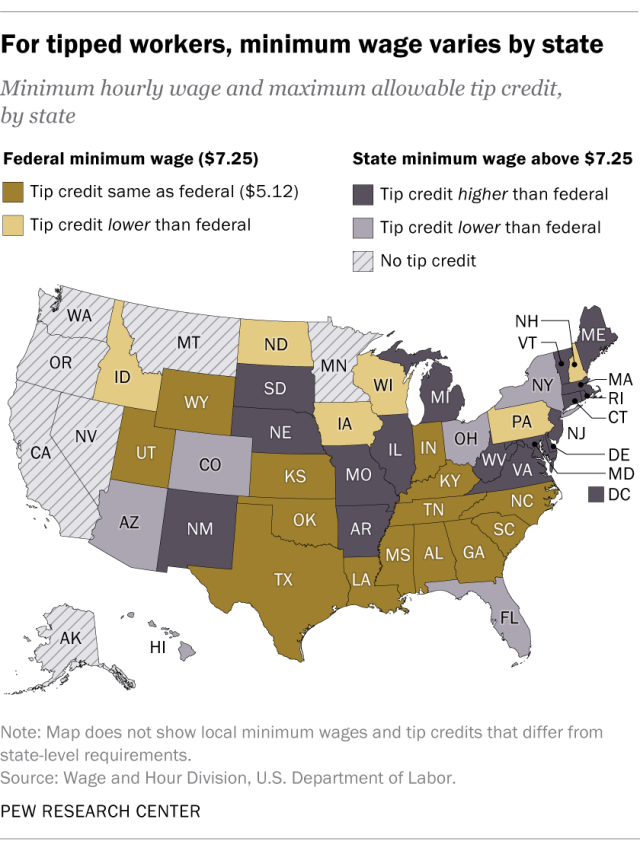

Under federal law, the minimum wage for most workers is $7.25 an hour. However, employers of workers who “customarily and regularly” receive at least $30 a month in tips can pay those workers just $2.13 an hour in direct wages, as long as they also receive the equivalent of at least $5.12 an hour in tips. That way, their full pay at least equals the $7.25 minimum. That $5.12 is called the “tip credit,” and if an employee does not earn at least that much in tips, the employer must make up the difference.

In 14 states, the federal rules are the last, or almost-last, word on minimum wages for tipped workers. (Oklahoma has slightly different rules for very small businesses.) But the federal law is a floor, not a ceiling, and states are free to set their own, higher minimum wages and tip credit rules.

The result is a patchwork system where, for example, a restaurant server in Waukegan, Illinois, is entitled to a $13 minimum wage – $7.80 in direct wages from the restaurant, plus a $5.20 tip credit. But for a server 17 miles away in Kenosha, Wisconsin, the minimum is $7.25 – with $2.33 in direct wages from the restaurant, plus a $4.92 tip credit.

Related: Do You Tip More or Less Than the Average American?

Thirty states and the District of Columbia currently have minimum wages that are higher than the federal standard, ranging from $8.75 an hour in West Virginia to $17 an hour in D.C. In 17 of those states and D.C., the tip credit also is higher: Virginia’s minimum wage, for example, is $12 an hour, but employers can use tips to offset up to $9.87. That means the minimum cash wage payable by the employer, $2.13, is the same as under federal law.

Six states not only have higher hourly minimums but lower tip credits than the federal standard. In Arizona, for instance, the minimum wage is $13.85, but employers can use tips to offset just $3 of that amount. And six other states use the federal minimum wage of $7.25 but have smaller tip credits than federal law authorizes.

Seven states – most of them in the West and all with higher state minimum wages than the federal one – don’t allow tip credits at all. That means tipped workers are paid the full minimum wage from their employers and can keep tips on top of that.

CORRECTION (Nov. 28, 2023): A previous version of the map in this analysis included an incorrect category label that said “Tip credit higher than federal.” The label has been updated to “Tip credit lower than federal.”