The COVID-19 pandemic is reshaping the U.S. labor market more than any single event since at least the Great Recession of 2007-09 and the financial panic that accompanied it. Employers shed nearly 20 million jobs between March and April 2020, according to government data, and payroll employment has yet to recover to pre-pandemic levels. Workers are quitting their jobs at a record pace, particularly in lower-paid sectors such as retail and food service, and many employers are scrambling to lure replacements with raises and bonuses.

At least, that’s the broad picture. But those wage gains have been distributed unevenly throughout the workforce, with workers in some sectors and industries seeing far smaller gains than those in others. And workers’ real purchasing power has been eroded by sharply higher inflation. (This analysis focuses on average weekly wages and employment levels in the private sector, where around 85% of Americans work.)

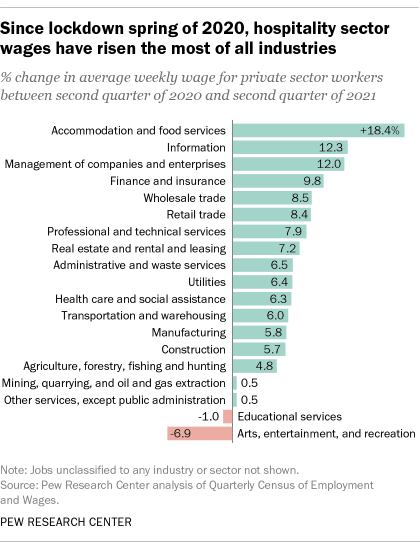

Almost two-thirds of U.S. private sector payroll workers (63.6%) work in industries where the average weekly wage in the second quarter of 2021 was at least 5% higher than it was in the second quarter of 2020, according to the most recently available data from the Quarterly Census of Employment and Wages, a product of the federal Bureau of Labor Statistics.

With high quit rates and widespread reports of worker shortages in the United States, many businesses are raising worker pay and offering bonuses to attract – and just as importantly, retain – their staffs. But, we wondered, how widespread have such wage gains been, and which industries are raising pay the most?

We turned for answers to the Quarterly Census of Employment and Wages (QCEW), which is produced by the federal Bureau of Labor Statistics. Unlike the BLS’s monthly surveys of households and employers, the QCEW draws its data primarily from state unemployment insurance programs; it is estimated to cover more than 95% of all U.S. jobs, and goes into much greater industry and geographic detail than BLS’s monthly jobs report.

The trade-off, as is often the case, is timeliness: The freshest QCEW data is from the second (April-June) quarter of 2021. Since employment tends to be seasonal and the QCEW data isn’t adjusted for seasonal variations, we focused on comparing the second quarter of 2021 with the same quarter in 2019 and 2020. We concentrated on private sector employment because that’s where most Americans work – roughly 85%, according to the most recent employment report.

The “accommodation and food services” sector – including restaurants, bars, hotels and the like – had the biggest increase in average weekly wages since the second quarter of 2020, when much of the sector was either shut down or sharply curtailed because of the pandemic. The average wage for workers in this sector rose 18.4%, to $482 a week, after dropping 4.9% between the second quarter of 2019 and the same period in 2020. (Over that same period, average employment in the sector plummeted 38%.) But despite the recent wage increases, this was still the lowest-paying sector.

The two sectors with the next biggest wage gains were information (which includes, among other industries, software publishing and “internet publishing and web search portals”) and company management. These are also the highest-paying sectors overall.

Average weekly wages in the information sector rose 12.3%, to $2,740, between the second quarter of 2020 and the second quarter of 2021 – almost as much as they rose in the corresponding 2019-20 period. Management pay rose an average 12%, to $2,513 a week, between mid-2020 and mid-2021, after staying nearly flat in the year-earlier period.

Pandemic-related job losses in the information and management sectors weren’t just considerably smaller than in accommodation and food services – perhaps because many more information and management workers could work from home – but by this year’s second quarter, those two high-paying sectors had regained most of the workers they lost. By contrast, employment in accommodation and food services was still 15% below its level in the second quarter of 2019.

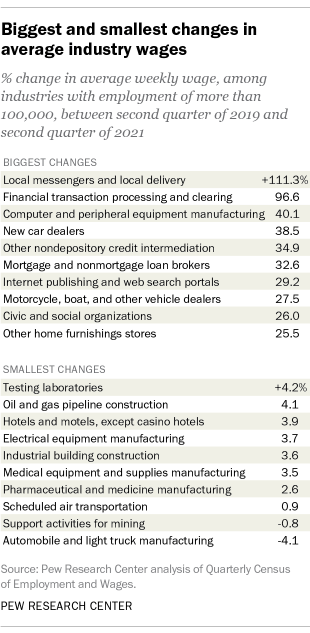

To get a more detailed view of pay patterns, we drilled down from broad sectors and looked at detailed industries that employed more than 100,000 people. (Small industries are more prone to dramatic fluctuations in both pay and workforce: The industry with the biggest average wage gain between the second quarters of 2020 and 2021, “other traveler accommodation,” employs only around 30,000-35,000 people in bed-and-breakfasts, youth hostels and other non-hotel types of lodging.) Also, it’s important to note that, especially at the industry level, reported wage changes can be affected by changes in the composition of that specific workforce.

Of that subgroup of industries, which accounts for 106.6 million jobs, the wage growth leader was financial transaction processing and clearing. Average pay for the 126,000 or so people in that industry more than doubled between the second quarter of 2020 and the second quarter of 2021, from $2,110 to $4,247. Other leading industries included local messengers and delivery people (up 92.6%), new car dealers (up 40.4%) and dentists’ offices (up 27.6%).

Many of the industries in this subgroup that notched the biggest wage gains between the second quarter of 2020 and the second quarter of 2021 had experienced wage declines during the early months of the pandemic. In 2020’s second quarter, for example, average wages for dental workers were 13.3% below their level a year earlier.

For that reason, we also decided to compare wages in the second quarter of 2021 against the same quarter in 2019, to see where the biggest overall gains have been. The wage winners this time were local messengers and delivery people, whose average weekly wage more than doubled over the period in question – from $680 to $1,437. Financial transaction processing and clearing was close behind, with a two-year gain of 96.6%. Further back were computer and peripheral equipment manufacturing (up 40.1%), new car dealers (38.5%) and a nonbank lending category dominated by mortgage lenders (up almost 35%).