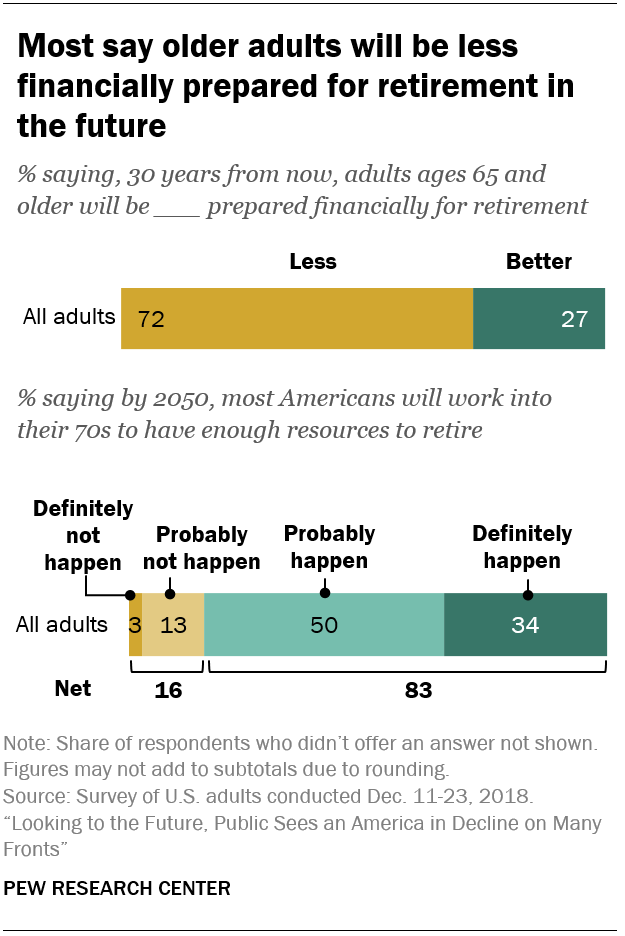

Looking to the future, Americans are pessimistic about the financial health of older Americans. Most say that, 30 years from now, those ages 65 and older will be less prepared for retirement than their counterparts today. And, among those who have not yet retired, a large majority (83%) doubt that Social Security will provide benefits at current levels when they eventually retire. About as many predict that most people will have to work into their 70s in order to afford to retire.

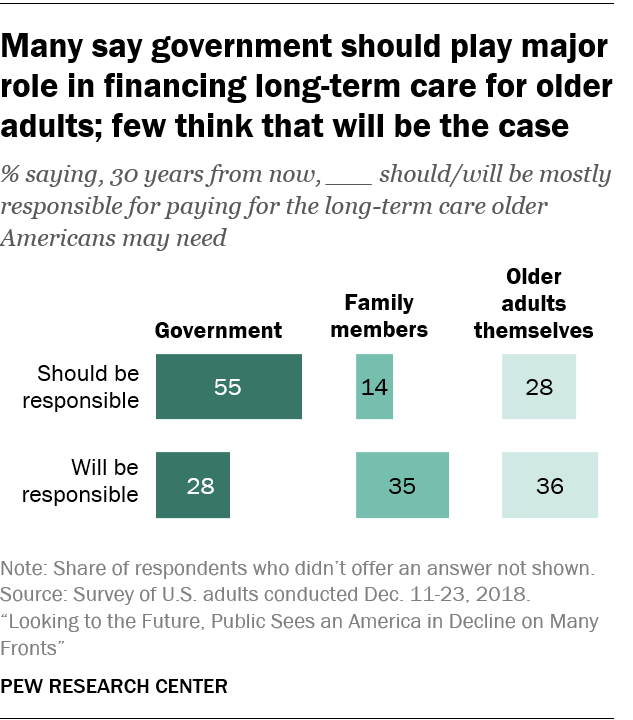

The public has little confidence that the government, rather than family members or older adults themselves, will take responsibility for financing the care older adults may need. While 55% say the government should play this role in the future, only 28% say the government will be responsible for this.

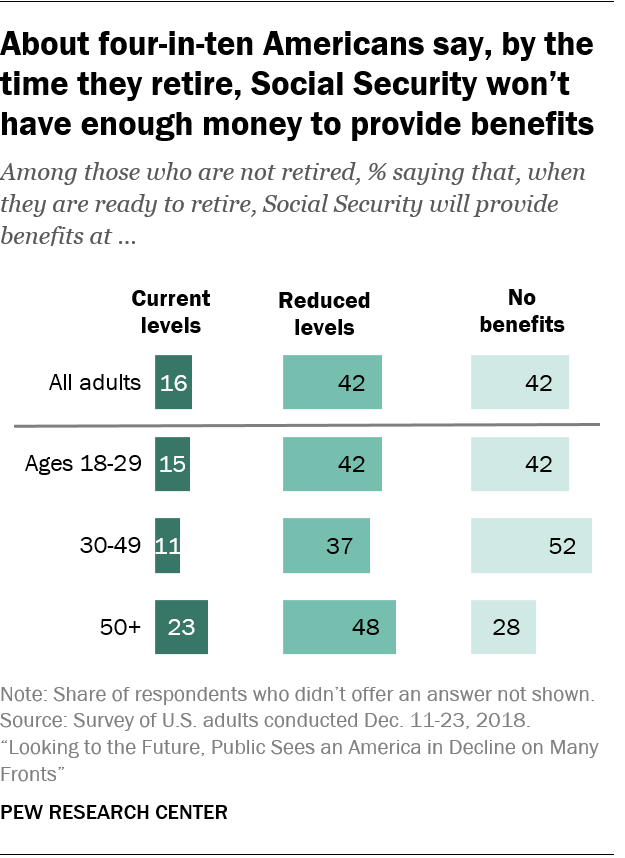

There is widespread skepticism about the future solvency of the Social Security system. Among those who are not retired, about four-in-ten (42%) doubt they will receive any Social Security benefits when they leave the workforce, while an additional 42% say benefits will be provided but at a reduced level.

These views differ significantly by age. Roughly half of Americans (48%) who are younger than 50 expect to receive no Social Security benefits when they retire. By contrast, about three-in-ten (28%) of those who are 50 or older are similarly pessimistic. But, even among this older group, relatively few (23%) expect to receive Social Security benefits at current levels.

Democrats and Republicans are united in their skepticism about the future of Social Security. Among those who are not retired, identical shares from each party (42%) say they don’t expect to receive benefits when they stop working.

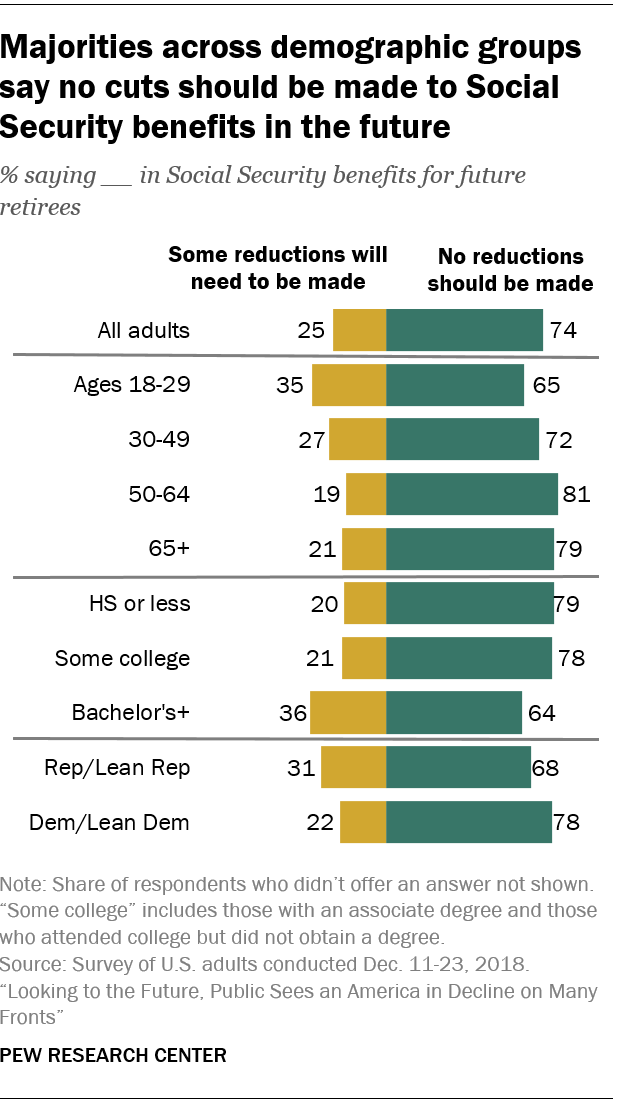

Amid doubts about the soundness of the Social Security system, most Americans reject the idea of reducing benefits for future retirees. When asked to think about the long-term future of Social Security, only 25% say some reductions in benefits for future retirees will need to be made, while 74% say benefits should not be reduced in any way.

Amid doubts about the soundness of the Social Security system, most Americans reject the idea of reducing benefits for future retirees. When asked to think about the long-term future of Social Security, only 25% say some reductions in benefits for future retirees will need to be made, while 74% say benefits should not be reduced in any way.

Views on this differ somewhat by age, with younger adults more likely to say that some cuts in future benefits will be necessary. Among those ages 18 to 29, about a third (35%) hold this view compared with 27% of those ages 30 to 49 and 20% of those ages 50 and older. Views also differ by educational attainment: While roughly a third of those with a bachelor’s degree or more education (36%) say benefits will have to be reduced for future retirees, only about one-in-five (21%) of those with less education agree.

Democrats and Republicans differ modestly on the need to cut Social Security benefits. Republicans are more likely than Democrats to say reductions in future benefits are inevitable (31% vs. 22%). Still, majorities across nearly all demographic and political groups say Social Security benefits should not be reduced in any way.

Most say Americans will work into their 70s in the future in order to have the resources to retire

Thinking more broadly about what the future will look like for older adults, most Americans say adults ages 65 and older will be less prepared financially for retirement 30 years from now than today’s older adults are. Fully 72% express this view, while only 27% say older adults will be better prepared for retirement in the future.

Thinking more broadly about what the future will look like for older adults, most Americans say adults ages 65 and older will be less prepared financially for retirement 30 years from now than today’s older adults are. Fully 72% express this view, while only 27% say older adults will be better prepared for retirement in the future.

Blacks and Hispanics are somewhat more optimistic about this than whites, and those without a bachelor’s degree are somewhat more upbeat than those with more education. Even so, the predominant view across all major demographic groups is that adults ages 65 and older will be less prepared for retirement 30 years from now compared with those who are that age today.

Consistent with these concerns, a large majority of adults think that, in 30 years, most Americans will work into their 70s in order to have enough resources to retire. About a third of adults (34%) say this will definitely happen, and an additional 50% say this will probably happen. Relatively few think adults will probably not have to work longer to retire (13%), while 3% say they definitely won’t.

Most demographic groups generally agree that people in the future will have to work longer to be financially secure enough to retire. Young adults ages 18 to 29 are somewhat less likely than their older counterparts to say this will definitely happen (25% vs. 36% of those ages 30 and older), but large majorities across all age groups say it is at least probable.

Most say cost of long-term care for older adults will fall to families, individuals

With a growing number of older adults and increased life expectancy, questions about who will care for those who can’t care for themselves and who will bear the cost of that care loom large. There’s a disconnect between who the public thinks should be responsible for paying for the care of older adults may need and who the public thinks will end up being responsible.

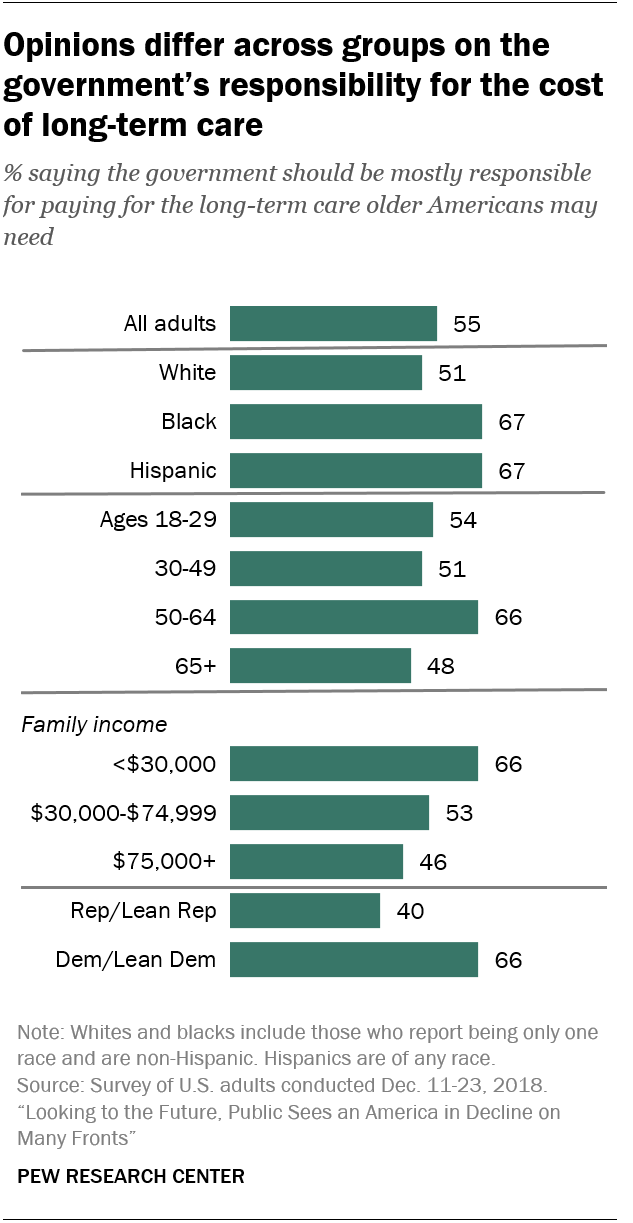

A narrow majority of Americans (55%) say that, 30 years from now, government should be mostly responsible for paying for the long-term care older adults may need. About three-in-ten (28%) say older adults themselves should be responsible for bearing these costs; 14% say family members should be responsible.

A narrow majority of Americans (55%) say that, 30 years from now, government should be mostly responsible for paying for the long-term care older adults may need. About three-in-ten (28%) say older adults themselves should be responsible for bearing these costs; 14% say family members should be responsible.

But, when asked who will likely be most responsible in the future for paying for this care, a majority of Americans say the burden will mainly fall on older adults themselves (36%) or their families (35%). A somewhat smaller share (28%) say government will be mostly responsible for paying for the long-term care older adults may need in the future.

Key demographic groups differ about who should pay for long-term care, but there is more agreement over who will be responsible.

Two-thirds of blacks and Hispanics say government should be mostly responsible for paying for long-term care, while about half of whites (51%) say the same. Adults ages 50 to 64 – those approaching retirement age – are more likely than other age groups to say government should be mostly responsible for this (66% of 50- to 64-year-olds say this compared with about half of all other age groups, including those 65 and older).

Lower-income adults are also more likely to say government should have the primary responsibility for this – 66% among those with annual family incomes below $30,000 hold this view, compared with about half of those with higher incomes.

Not surprisingly, Republicans and Democrats have different views about who should pay for long-term care. Republicans are evenly divided over whether government (40%) or older adults themselves (40%) should be mostly responsible for paying for the long-term care older adults may need. An additional 18% of Republicans say family members should be responsible for this. Democrats see a much bigger role for government than for individuals or families. Two-thirds of Democrats say government should be primarily responsible for this, while 21% say the responsibility should fall to individuals themselves, and 11% point to family members.

When it comes to who will be most responsible for shouldering the cost of long-term care for older adults in the future, Democrats and Republicans do not differ significantly in their views. Whites (41%) are more likely than blacks (27%) and Hispanics (20%) to say older adults themselves will be the ones to pay for this care. Higher-income adults (43% among those in families with incomes of $75,000 or more) are more likely than those with lower incomes (33%) to say the same.