This chapter focuses on how much parents have prepared their young adult children (those ages 18 to 34) to be independent adults and the extent to which young adults with at least one living parent are financially independent.

Among the key findings:

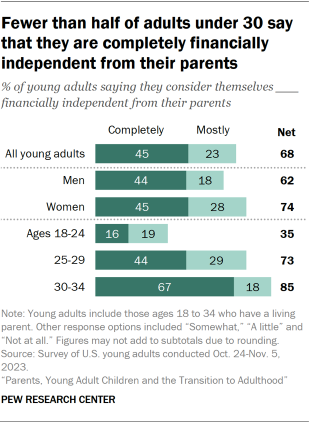

- 45% of young adults say they are completely financially independent from their parents. Among those in their early 30s, that share rises to 67%, compared with 44% of those ages 25 to 29 and 16% of those ages 18 to 24.

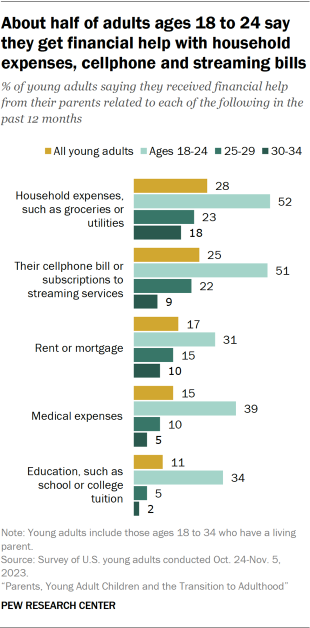

- 44% of young adults say they received financial help from their parents in the past year. The top two areas in which they got help were household expenses and their cellphone bill or subscriptions to streaming services.

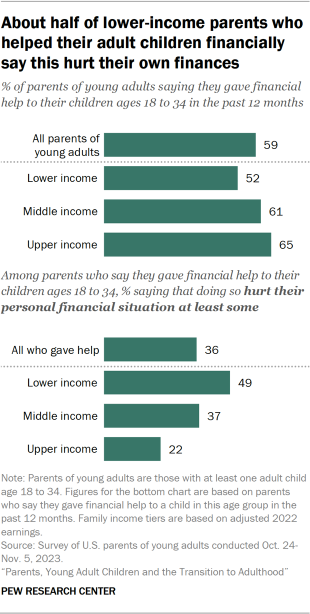

- Among parents who say they helped their children financially in the past year, 36% say doing so has hurt their personal financial situation at least some. This is especially the case among parents with lower incomes.

- Most young adults who live with their parents say they contribute financially, including 65% who say they pay for household expenses such as groceries or utility bills and 46% who say they contribute money toward the rent or mortgage.

Preparing children to be independent adults

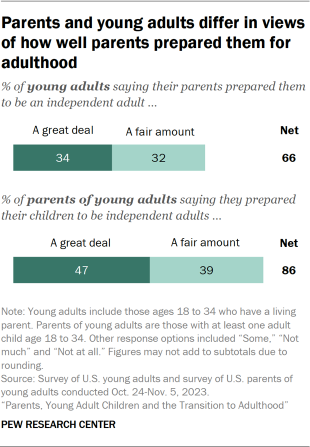

Most young adults (66%) say their parents did a great deal or a fair amount to prepare them to be an independent adult. Views are similar among those ages 18 to 24, 25 to 29 and 30 to 34.

Still, young adults are less likely than their parents to say this is the case. More than eight-in-ten parents of young adults (86%) say they did a great deal or a fair amount to prepare their children to be independent adults.

The shares of young adults saying their parents prepared them a great deal or a fair amount vary by income. Large majorities of those with upper or middle incomes say this (85% and 73%, respectively). A much smaller share of young adults with lower incomes (53%) say their parents did a great deal or a fair amount to prepare them to be independent adults.

There are also differences by income level among parents: 53% of upper-income parents say they’ve done a great deal to prepare their children to be independent adults, compared with 46% of parents with middle incomes and 45% of those with lower incomes.

Financial independence and giving financial help to young adult children

What young adults say

About two-thirds of young adults (68%) say they are completely or mostly financially independent from their parents, with 45% saying they are completely financially independent.

Assessments vary considerably by age group. Two-thirds of those ages 30 to 34 say they are completely financially independent, compared with 44% of those ages 25 to 29 and just 16% of those ages 18 to 24.

Young women are more likely than young men to say they are at least mostly financially independent from their parents (74% vs. 62%). Similar shares of both groups say they are completely financially independent.

Three-quarters of young adults who say they’re not completely financially independent say it’s extremely or very likely that they will eventually be.

Those with a bachelor’s degree or more education are the most confident that they will eventually become completely financially independent: 60% say this is extremely likely, compared with 46% of those with some college or less education. Majorities of 70% or more in both groups say this is at least very likely to happen.

What parents say

For these questions, we asked parents with more than one child in the 18-to-34 age range to think of a specific child (who was randomly selected).3 For the most part, their answers match those of the young adults surveyed: 65% of parents say their child is completely or mostly financially independent from them, with 44% saying their child is completely financially independent.

Parents’ answers vary based on the age of the child. Most (62%) of those answering about a child age 30 to 34 say their child is completely financially independent. This compares with 54% of parents answering about a child age 25 to 29 and just 23% of those answering about an adult child younger than 25.

Most parents who say their child is not completely financially independent (72%) think it is extremely or very likely they will eventually be.

Who is most likely to be receiving financial help from parents, and for what purposes?

Overall, 44% of adults ages 18 to 34 who have a living parent say they received financial help from their parents in the past 12 months. This ranges from 30% among those ages 30 to 34 to 68% among adults younger than 25. Young men and women are equally likely to say they received financial help from their parents.

The top two areas in which young adults say they received financial help from their parents are:

- Household expenses (28% of all young adults say they received help for this)

- Their cellphone bill or subscriptions to streaming services (25%)

Smaller shares of adults ages 18 to 34 say they received financial help related to:

- Rent or mortgage (17%)

- Medical expenses (15%)

- Education (11%)

Young adults ages 18 to 24 are more likely than those ages 25 to 29 and 30 to 34 to say they’ve received financial help from their parents in each of these five areas in the past year.

How helping adult children financially impacts parents’ finances

A majority of parents with children ages 18 to 34 (59%) say they gave financial help to a child in this age range in the past year. This is larger than the share of young adults who say they received help from their parents. This may be, at least in part, because some parents have more than one child in this age group and, for this question, they were asked to think about any of their children.

Parents with upper (65%) and middle incomes (61%) are more likely than those with lower incomes (52%) to say they gave financial help to their children.

For the most part, parents say that helping young adult children financially doesn’t have a negative impact on their own finances. More than six-in-ten of those who say they helped their children (64%) say doing so didn’t hurt their personal financial situation much or at all.

There are differences by income, however. About half of parents with lower incomes who say they provided financial help to their young adult children in the past year (49%) say this hurt their own finances at least some. Smaller shares of those with middle (37%) and upper incomes (22%) say the same.

Getting financial help from young adult children

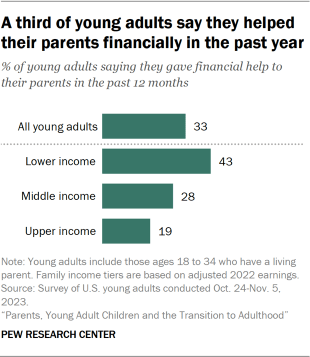

While it is more common for young adult children to receive financial help from their parents than it is for them to give help, 33% say they helped their parents financially in the past year. A smaller share of parents (14%) say they received financial help from their children ages 18 to 34.

Young adults with lower incomes (43%) are more likely than those with middle (28%) or upper incomes (19%) to say they helped their parents financially. Similarly, parents with lower incomes are the most likely to say they received financial help from their young adult children (29%, compared with 9% of those with middle incomes and 2% of parents with upper incomes).

Among parents who received financial help from their children, 38% say the help was for special circumstances, 31% say it was for recurring expenses and 30% say it was for both.

Young adults’ financial contributions when they live with their parents

Today’s young adults are more likely to be living with their parents than young adults in the early 1990s, when their parents were around the same age. (Read more in Chapter 1 of this report.)

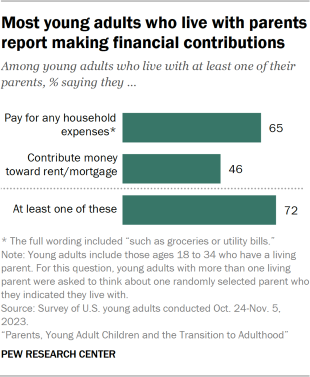

Most young adults who live with their parents say they contribute financially to the household in some way.

- 65% say they pay for household expenses such as groceries or utility bills.

- 46% say they contribute money toward the rent or mortgage.

- 72% contribute in at least one of these areas.

The impact of parents and young adult children living together

Young adults were asked about the impact of their living arrangement on various aspects of their life, including their personal finances and their relationship with their parent. Parents were only asked about the impact on their finances and their relationship with their child. For this question, we asked respondents to think of a specific parent or child they live with, chosen at random.

Personal finances

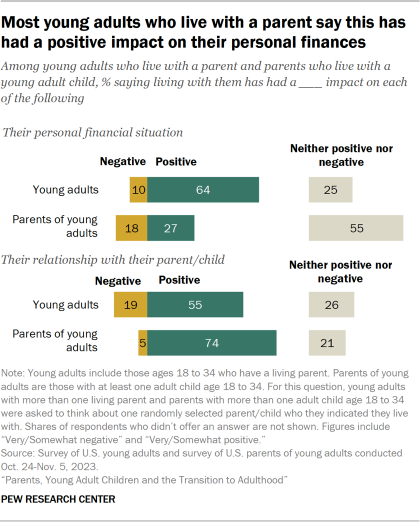

Most young adults who live with a parent (64%) say their living arrangement has had a very or somewhat positive impact on their personal financial situation.

In turn, just 27% of parents who live with a young adult child say the same about the impact on their own finances (55% of these parents say the impact has been neither positive nor negative).

Relationship with their child/parent

Most parents who live with a young adult child (74%) say this has had a positive impact on their relationship with their child. This is larger than the share of young adults (55%) who say living with their parent as an adult has been positive for their relationship.

Other aspects of young adults’ lives

We also asked young adults who are living with a parent about the impact this has had on their sense of independence and their social life.

About three-in-ten say their living situation has been positive for their sense of independence (28%) and a similar share say the impact has been negative (32%). About four-in-ten (39%) say it’s had neither a positive nor a negative impact.

When it comes to their social life, 21% say living with their parent has had a positive impact and 24% say it’s had a negative impact; 54% say the impact has been neither positive nor negative.