College graduates without a college-educated parent have lower incomes and less wealth, on average, than those with a parent who has a bachelor’s or higher degree

Pew Research Center conducted this analysis to understand more about how the educational background of parents is linked to their children’s labor market and economic outcomes. Much has been written about the impact parental education has on children’s educational attainment, but less is known about the longer-term impact on economic well-being. Two surveys collected by the Federal Reserve are used to illuminate this relationship. The larger and more recent Survey of Household and Economic Decisionmaking (SHED) collects information on the type of college the adult attended and has a battery of questions on educational debt. The analysis examines adults ages 22 to 59, of which there are 7,429 unweighted respondents in the 2019 SHED. The SHED is not designed to precisely measure economic outcomes such as income and wealth. The well-known Survey of Consumer Finances (SCF) is the gold-standard for measurement of household wealth, and the 2019 collection ascertained the respondent’s parental levels of education. The SCF also has information on inheritances received and expected. This allows us to explore the relationship between the economic outcomes of the head of the household and parental education and some of the ways in which college-educated parents are able to transmit their wealth to their offspring.

In this report, references to college graduates or people who are college educated comprise those with a bachelor’s degree or more. Some college includes those with an associate degree, certificate, or technical degree and those who attended college but did not obtain a degree.

A first-generation college graduate refers to a person who has completed at least a bachelor’s degree but does not have a parent who has completed at least a bachelor’s degree. A second-generation college graduate has at least one parent who has completed at least a bachelor’s degree.

Net worth or wealth is the difference between the value of what the household owns (assets) and what it owes (debts).

References to White and Black adults include only those who are not Hispanic and identify as only one race. Hispanics are of any race.

Even as the cost of college continues to rise, with student debt levels climbing along with it, the long-term financial benefits of a four-year college degree remain indisputable. Adults who have attained at least a bachelor’s degree have better economic outcomes, on average, than adults who have not completed college. They tend to earn more and accumulate more wealth.

But the economic benefits are not equally felt among college graduates. A new Pew Research Center analysis of data from the Federal Reserve Board finds that first-generation college graduates are not on equal footing with their peers who have college-educated parents. Among household heads who have at least a bachelor’s degree, those who have a parent with a bachelor’s degree or more education have substantially higher incomes and more wealth than those who are the first generation in their family to graduate from college.

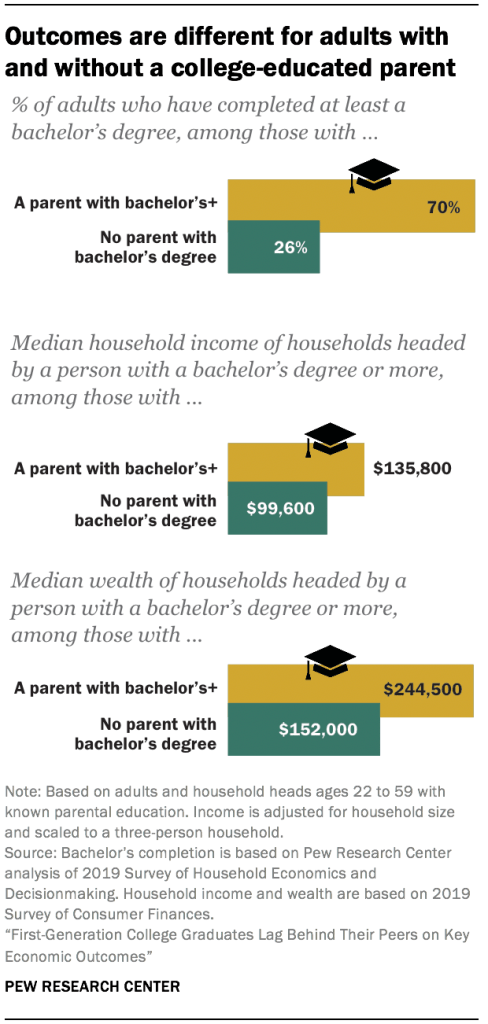

Adults who have at least one college-educated parent are far more likely to complete college compared with adults with less-educated parents. Some 70% of adults ages 22 to 59 with at least one parent who has a bachelor’s degree or more education have completed a bachelor’s degree themselves. Only 26% of their peers who do not have a college-educated parent have a bachelor’s degree.

Scholars and higher education administrators have focused on the many challenges facing students whose parents have never attended college.1 Enrolling in U.S. higher education is a complicated multistep process that includes completing college prep coursework in high school and navigating the admissions and financial aid process. Whether labelled “college knowledge” or “cultural capital,” students whose parents have their own experience and success in how to go to college have greater access to postsecondary education. Once on campus, students whose parents have not attended college are less likely to complete a degree.

For adults who do complete a bachelor’s degree, financial outcomes are strongly linked to parental educational attainment. The median household income for households headed by a first-generation college graduate ($99,600) is substantially lower than the income for households headed by a second-generation graduate ($135,800).

The median wealth of households headed by a first-generation college graduate ($152,000) also substantially trails that of households headed by a second-generation college graduate ($244,500). The higher household income of the latter facilitates saving and wealth accumulation. The gap also reflects differences in how individuals finance their education. Second-generation college graduates tend to come from more affluent families. First-generation college graduates are more likely to incur education debt than those with a college-educated parent. They also have greater amounts of outstanding education debt.

The benefits of having a college-educated parent don’t necessarily extend to those who don’t graduate from college themselves. Among adults who have not graduated from college, there is no substantial economic boost associated with having a parent with at least a bachelor’s degree.

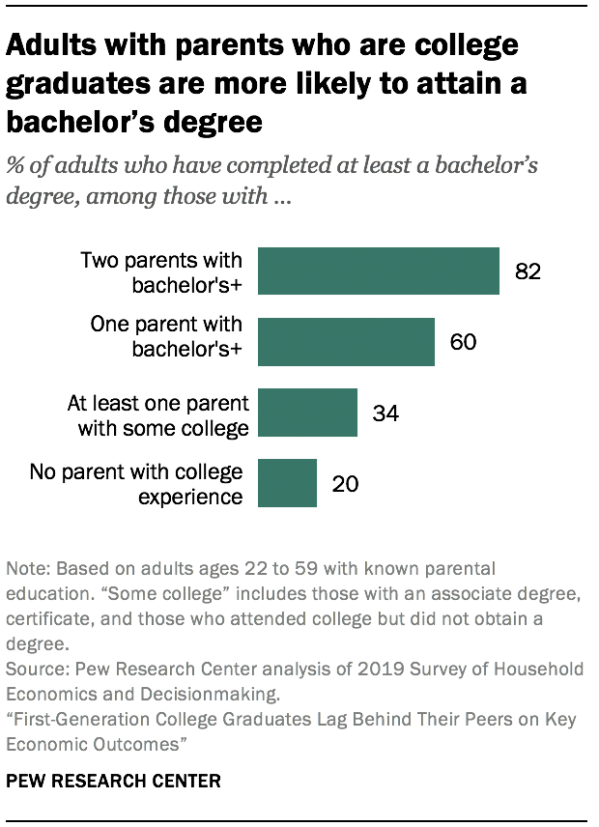

Adults with college-educated parents are much more likely than others to have graduated from college themselves

The likelihood of an adult completing a bachelor’s degree increases as their parents’ educational attainment rises. Among adults ages 22 to 59 whose parents have no education beyond high school, 20% have completed at least a bachelor’s degree.2 Among those who have at least one parent who has completed some college, 34% have finished a bachelor’s degree. The share rises substantially for adults with one parent who has at least a bachelor’s degree, 60% of whom have completed college. Among adults whose parents have both finished college, 82% have at least a bachelor’s degree.

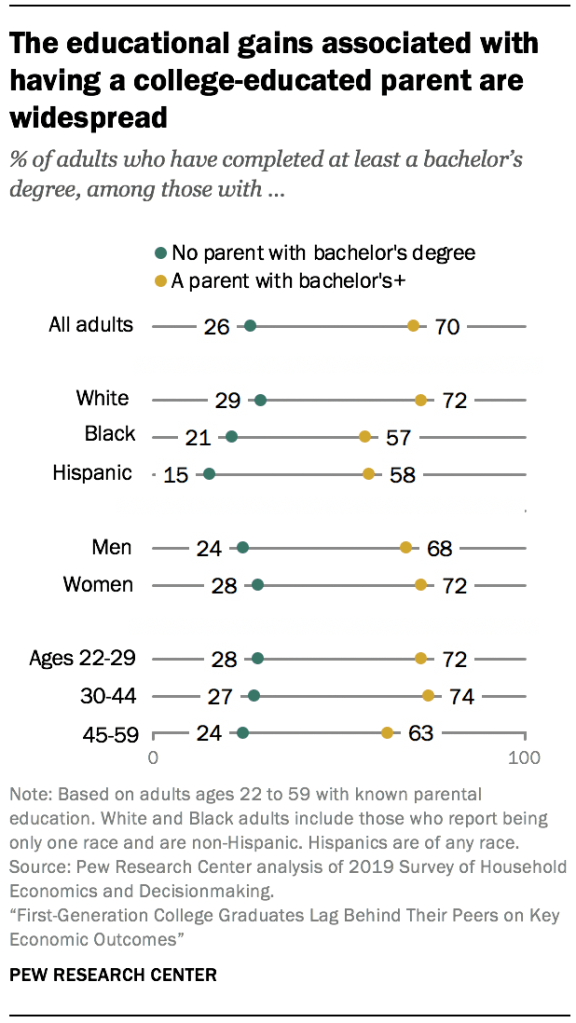

This pattern is consistent across demographic groups. Among White adults, those with at least one parent who has a bachelor’s degree or more education are more than twice as likely to be college graduates themselves as those who don’t have a college-educated parent (72% vs. 29%). Black adults who have a parent with at least a bachelor’s degree are also much more likely to have finished college than Black adults who don’t have a college-educated parent (57% vs. 21%). For Hispanic adults, the pattern is similar: 58% of those with a college-educated parent have a bachelor’s degree themselves. By comparison, only 15% of those who don’t have a college-educated parent are bachelor’s degree holders.

Among both men and women, those with a parent who has obtained at least a bachelor’s degree are much more likely to have graduated from college than those whose parents did not attain at least bachelor’s degree.

And while younger adults are more likely to have completed at least a bachelor’s degree than older adults, the advantage associated with having a college-educated parent is similar across age groups. For example, among 22- to 29-year-olds, those with a college-educated parent are more than twice as likely to have completed a bachelor’s degree as those without a college-educated parent (72% vs. 28%). The pattern is similar among 45- to 59-year-olds: 63% of those with a college-educated parent have a bachelor’s degree compared with 24% of those without a college-educated parent.

The type of higher education institution adults attended differs according to their parents’ educational attainment

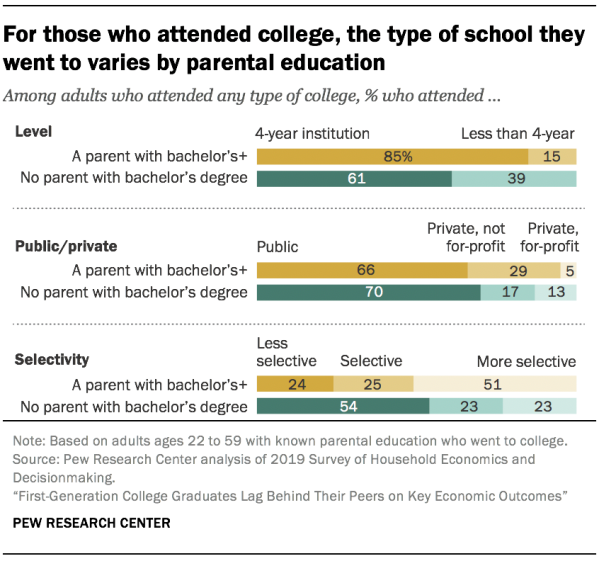

Not only is parental education linked to college completion, it is also related to the type of institution a person attends. Among adults who attended college, those who have a parent with a bachelor’s degree or more education are more likely than those without a college-educated parent to have gone to a four-year institution (85% vs. 61%, respectively).3

Research has shown that students who initially attend a four-year college or university are more likely to complete a bachelor’s degree than those who attend a two-year institution.4 Adults who have completed a bachelor’s degree tend to earn substantially more than those with some college.

Patterns also differ by type of college or university. Among adults who attended college, those with a college-educated parent are more likely than first-generation college students to have attended a private institution (29% vs. 17% of those without a college-educated parent). The latter group is more likely than those with a college-educated parent to have attended a private, for-profit institution.5

In addition, the selectivity of the college an individual attends differs based on their parents’ educational attainment. Among those who attended college, adults with a parent who has a bachelor’s degree or more education are more likely than those without a college-educated parent to have attended a “more selective” school (51% vs. 23%, respectively). By contrast, those who don’t have a parent with a four-year college degree are much more likely to have attended a less selective college – 54% vs. 24% of those with a college-educated parent.6 Previous research has shown that the admissions selectivity of the institution impacts the likelihood of completion.

The household incomes of first-generation college graduates lag those of other graduates

Beyond a boost in educational attainment, adults who have a college-educated parent enjoy, on average, better economic returns.

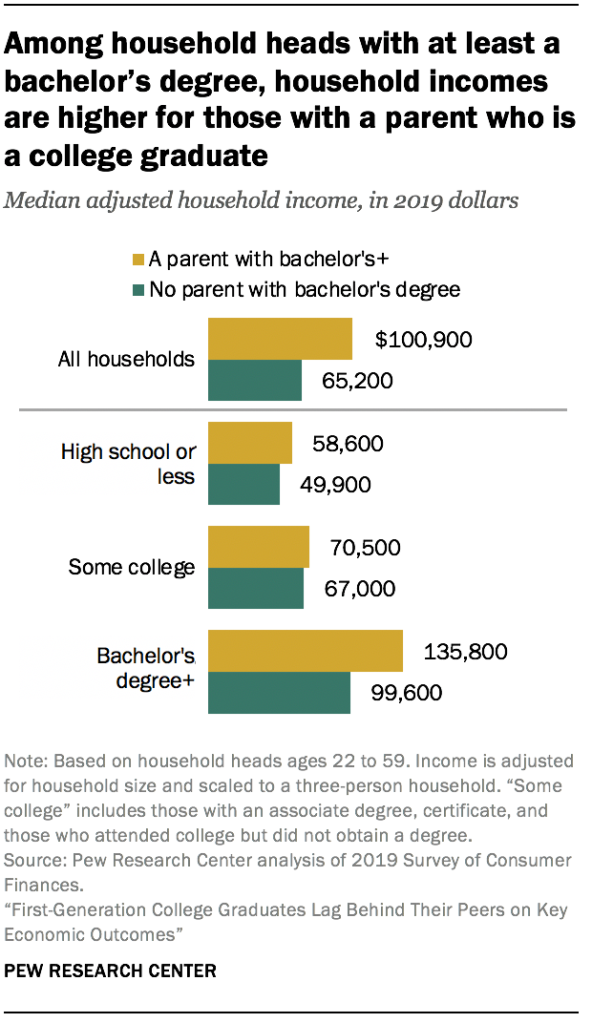

Households headed by an adult age 22 to 59 who has a parent with at least a bachelor’s degree had a median adjusted household income in 2019 of $100,900 – significantly above those headed by an adult whose parents lack a bachelor’s degree ($65,200). This partly reflects that the former household heads are more likely to have attained a bachelor’s degree than the latter.

The income advantage of having a parent who has at least a bachelor’s degree, sometimes dubbed the “parent premium,” is largely confined to college-educated household heads. The median household income for household heads who have a bachelor’s degree and a college-educated parent was $135,800 in 2019. By comparison, household heads with a bachelor’s degree whose parents did not graduate from college had a substantially lower median income – $99,600.

Among households headed by those with some college education, the difference in household income between those who have a parent with at least a bachelor’s degree ($70,500) and those who don’t ($67,000) is modest. The pattern is similar for household heads with a high school diploma or less education.

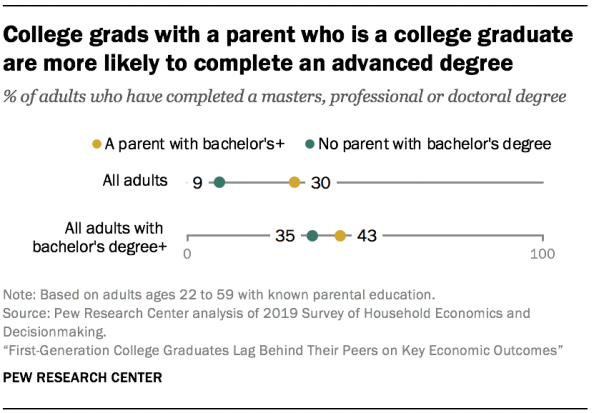

Some of the household income gap between college graduates with and without a college-educated parent likely reflects educational differences between these two groups. Second-generation college graduates are more likely to finish a master’s degree, professional degree or doctoral degree. Among 22- to 59-year-old college graduates, 43% of those who have a parent with at least a bachelor’s degree have completed an advanced degree. This compares with 35% of first-generation college graduates. Census data shows that household heads with a master’s degree have a median household income of $117,400. The median incomes of those holding professional and doctoral degrees are $162,100 and $142,300, respectively. Households heads having a bachelor’s degree but no advanced degree have a lower median income ($100,200).7

To be sure, there are differences in the demographic composition of households headed by first- and second-generation college graduates that may account for some of the differences in economic outcomes for these two groups. For example, Black and Hispanic college graduates, who tend to have lower median incomes than their White counterparts, make up a larger share of first-generation than second-generation graduates. Still, parental education matters even when taking race and ethnicity into account. A large income gap by parental education is apparent when the analysis is restricted to White families. Additional recent research finds that parental education matters for the earnings of Black and Hispanic college graduates.

The household income gap is not due to differences in marital status, as first-generation college graduates are as likely as other college graduates to be married.

Second-generation college graduates have substantially more wealth than first-generation college graduates

Similar to household income, there is a substantial wealth gap between households headed by a first-generation college graduate versus those headed by a second-generation college graduate, and, again, the difference is particularly pronounced among those with a bachelor’s degree. Wealth is different than the household’s income stream. Wealth is the value of all the assets owned by the household (cars, homes, financial assets, businesses, etc.) minus outstanding debts owed by the household. Wealth is valuable because it can be used to tide the household over if its income is interrupted (due to layoff, illness, or variable earnings) as well as fund retirement. It can also be used to pay for a child’s college expenses.

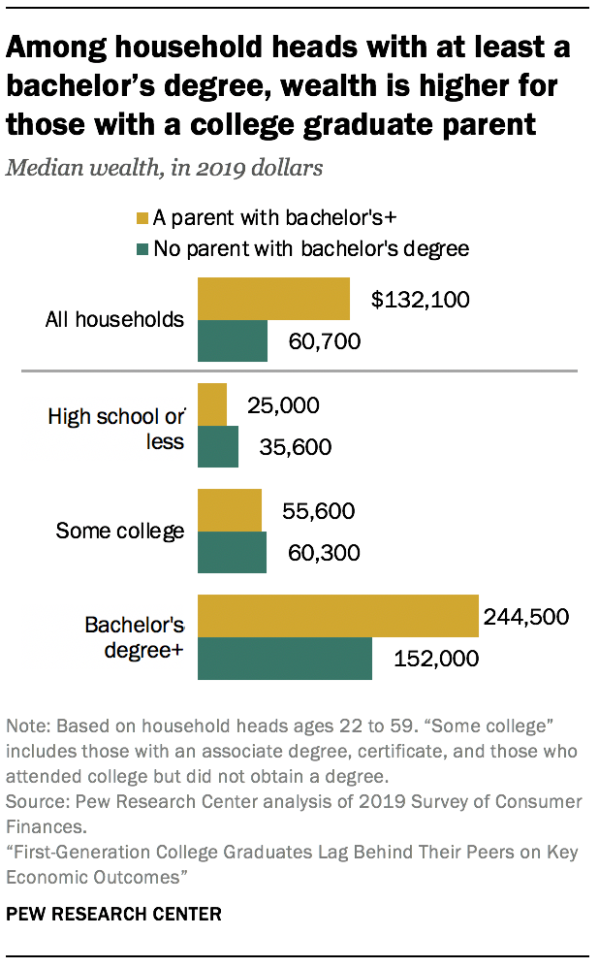

Households headed by an adult age 22 to 59 who has a parent with at least a bachelor’s degree have more than twice the median wealth ($132,100) of similar households headed by an adult without a college-educated parent ($60,700). This partly reflects the higher educational attainment of the former group, as median wealth steeply increases with the educational attainment of the household head. The typical wealth level of a household headed by a four-year college graduate is $202,500, far surpassing the wealth level of the typical household headed by a high school graduate ($31,200).8

Among households headed by a college graduate, the median wealth of those with a parent who has at least a bachelor’s degree ($244,500) is nearly $100,000 greater than the wealth of those who don’t have a college-educated parent ($152,000).9

The wealth disadvantage of households headed by a first-generation college graduate partly reflect their lower household income. Higher household income makes it easier for the household to save and accumulate wealth.

Educational debt is another factor that likely contributes to the wealth gap. First-generation college graduates are more likely to have incurred debt for their education than second-generation college graduates. The amounts outstanding also tend to be greater.

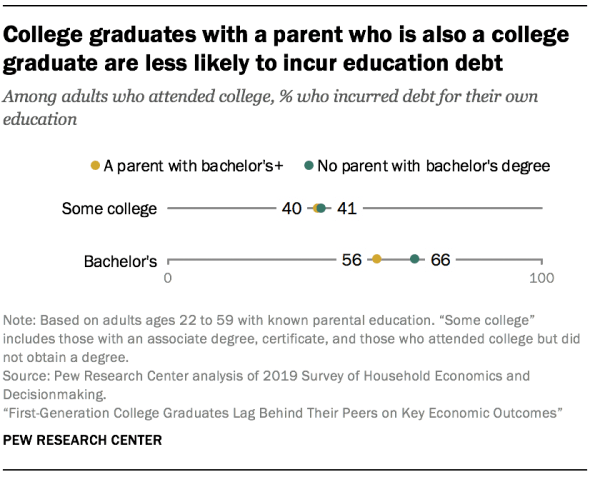

Two-thirds of first-generation college graduates incurred debt for their own education (this includes both those with outstanding debt and debt that has been repaid).10 In comparison, 56% of those with a college-educated parent incurred educational debt.11

Among college graduates with any outstanding debt for their education, first-generation college graduates tend to owe more. About two-thirds (65%) of first-generation college graduates owe at least $25,000 or more, compared with 57% of second-generation college graduates.12

Parental education does not influence the incidence and levels of education debt among adults who have not finished at least a bachelor’s degree. For example, adults with some college are roughly equally likely to report borrowing for their education regardless of their parents’ education levels.

Inheritance boosts the wealth levels of children of college graduates

Aside from paying for their college, another way in which college-educated parents can boost their children’s wealth is by directly transferring it to them, i.e., giving them an inheritance. Again, the benefit of having a college-educated parent is much more apparent if the child completes at least a bachelor’s degree. Differences in parental bequest behavior are modest for some adults who do not finish college.

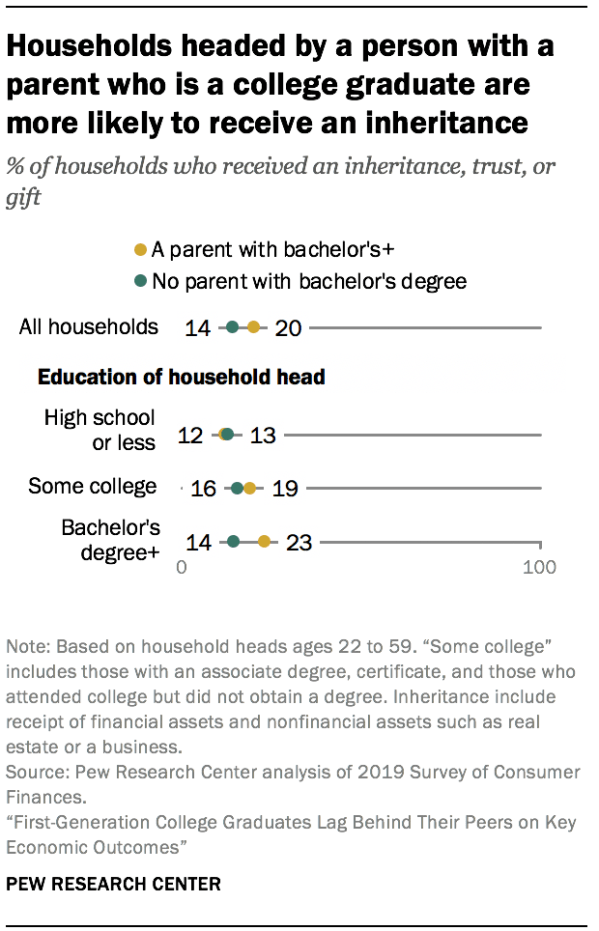

One-in-five household heads who has a parent with at least a bachelor’s degree report receiving an inheritance, trust, or substantial gift, in comparison to 14% of heads of less-educated parents. For households headed by a college graduate, 23% of those with a parent who is also college-educated have received an inheritance. By comparison, 14% of those without a college-educated parent report getting an inheritance.

Although some people haven’t received an inheritance, they may expect to at some point in the future.

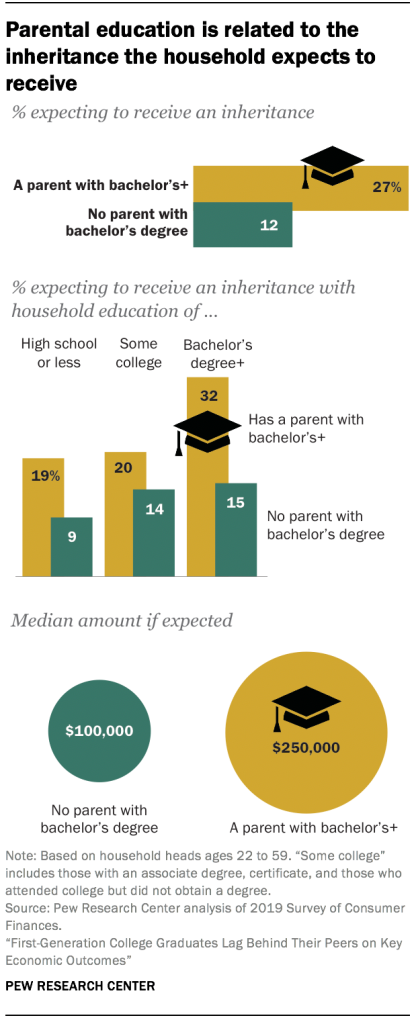

Household heads who have a parent who has completed a bachelor’s degree (27%) are about twice as likely as heads without a college-educated parent (12%) to expect to receive an inheritance at a later date.

Roughly a third (32%) of heads who are second-generation college graduates expect to receive an inheritance. Only 15% of heads who are first-generation college graduates expect an inheritance.

Parental education also influences the size of the inheritance expected. The median expected inheritance is $250,000 if the head has a parent who has finished at least a bachelor’s degree, this compares with $100,000 for heads who don’t have a college-educated parent.