In looking at student debt, two measures of a college graduate’s family affluence are typically considered: family income and parents’ educational attainment (Ellwood and Kane, 2000). The income analysis focuses on college graduates who were dependent on their parents for financial support and looks at the income of a graduate’s parents in the year before graduation.6 Since one year’s income does not necessarily reflect the family’s long-run income prospects, the highest education level of the graduate’s parents also measures socio-economic status.

In looking at student debt, two measures of a college graduate’s family affluence are typically considered: family income and parents’ educational attainment (Ellwood and Kane, 2000). The income analysis focuses on college graduates who were dependent on their parents for financial support and looks at the income of a graduate’s parents in the year before graduation.6 Since one year’s income does not necessarily reflect the family’s long-run income prospects, the highest education level of the graduate’s parents also measures socio-economic status.

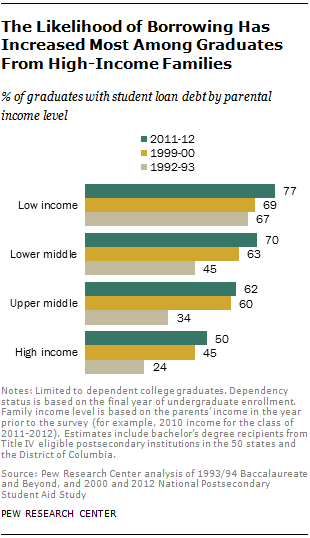

In the class of 2011-12, graduates from relatively poorer families were more likely to borrow than were their richer counterparts. Nearly four-in-five graduates (77%) from the lowest parental income quartile had accumulated some student debt by graduation compared with half of graduates from the richest parental income quartile.

Over time, graduates in all four parental income quartiles have increased their likelihood of graduating with some student debt. But the increase in borrowing rates has been particularly pronounced among graduates from more affluent families. In the class of 1992-93 less than one-quarter of graduates (24%) from the high-income quartile incurred student debt. By 2011-12 twice as many graduates from the high-income parental quartile took on student debt.

Borrowing rates have not increased as rapidly among graduates from less affluent families. In 1992-93 about two-thirds of graduates (67%) from the lowest income quartile of families graduated with debt. By 2011-12, 77% of similarly situated graduates borrowed.

Borrowing rates have not increased as rapidly among graduates from less affluent families. In 1992-93 about two-thirds of graduates (67%) from the lowest income quartile of families graduated with debt. By 2011-12, 77% of similarly situated graduates borrowed.

The tendency to borrow has increased for graduates of all income backgrounds, but particularly for graduates from middle- and high-income families.

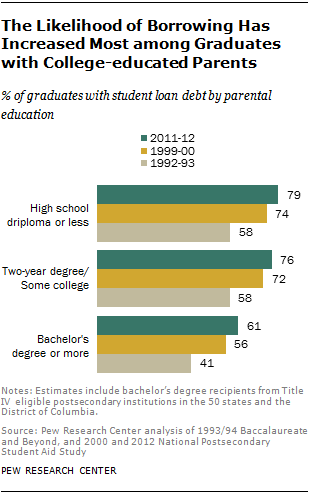

A similar pattern can be seen when graduates are classified by their parents’ education level.7 Among the class of 2011-12, about 79% of graduates whose parents had no formal education beyond high school incurred student debt. By contrast, only 61% of graduates with college-educated parents incurred debt. Over time though, the differences between graduates with more educated parents and less educated parents have narrowed. The likelihood of borrowing has increased particularly among graduates with college-educated parents.

Borrowing Rates by Gender

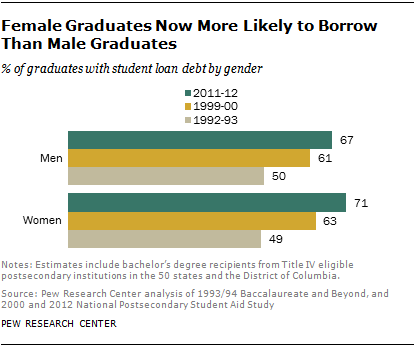

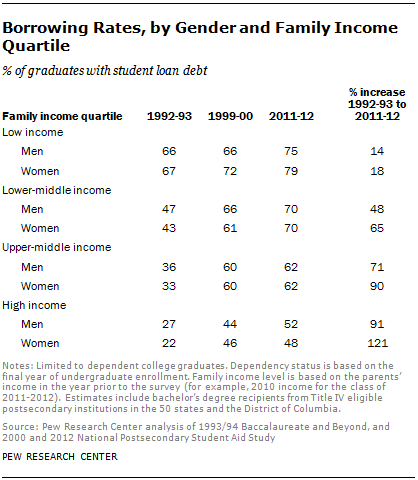

In the class of 2011-12, female graduates (71%) were slightly more likely to borrow than male graduates (67%). In the class of 1992-93, there was little gender difference in the likelihood of borrowing. Thus there is modest evidence that the increase in borrowing across the earlier and later classes has been concentrated among female graduates.

In the class of 2011-12, female graduates (71%) were slightly more likely to borrow than male graduates (67%). In the class of 1992-93, there was little gender difference in the likelihood of borrowing. Thus there is modest evidence that the increase in borrowing across the earlier and later classes has been concentrated among female graduates.

Socioeconomic background considerations suggest that female graduates are more likely than male graduates to borrow and rely on student lending programs. Growing research on the gender gap in college completion shows that female college students and graduates tend to be from more disadvantaged backgrounds than their male counterparts.

Since fewer disadvantaged men go to college than disadvantaged women (as measured by composite socioeconomic status), male college entrants tend be less disadvantaged than female entrants (Ewert, 2012).

The growing gender gap in college completion seems to mainly be attributable to the growing female advantage in college completion among children in less educated families. Sons with less educated fathers used to be more likely to finish college than daughters with less educated fathers. That pattern has now reversed (Buchmann and DiPrete, 2006), and the result is that a greater proportion of female college graduates come from more disadvantaged families.

In the class of 2011-12, 27% of dependent female college graduates were from the lowest parental income quartile, compared with 23% of their male peers. This contributes to why females have a higher borrowing rate.

In the class of 2011-12, 27% of dependent female college graduates were from the lowest parental income quartile, compared with 23% of their male peers. This contributes to why females have a higher borrowing rate.

Additional evidence that the increase in the likelihood of borrowing has been greater among female graduates compared with their male peers is available by examining borrowing rates within parental income groups. Within each income quartile the percentage increase in the borrowing rate from the class of 1993 to the class of 2012 was greater for women.

So the greater increase in borrowing by female college graduates may be due to additional factors beyond their socioeconomic background differences with male college graduates.

Summary: How Borrowing Patterns Have Changed

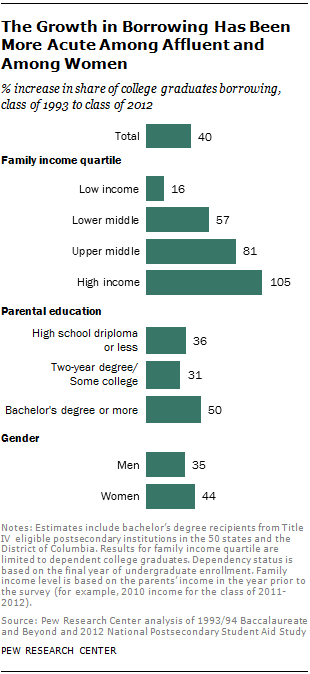

The likelihood of borrowing grew 40% from the class of 1992-93 (49% borrowed) to 2011-12 (69% borrowed). The increase in borrowing rates was greater among graduates from higher income families and families with more highly educated parents, and modestly greater among female graduates than male graduates.