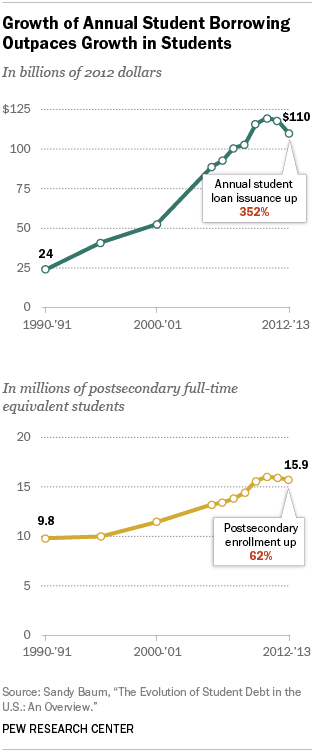

Student debt has increased dramatically over the past several decades. The aggregate volume of new student borrowing has increased more than fourfold over the past 20 years. In 2012-13 students borrowed $110 billion for higher education (Baum, 2013). By comparison, students borrowed only $24 billion in 1990-91 (both figures are in 2012 dollars).

Student debt has increased dramatically over the past several decades. The aggregate volume of new student borrowing has increased more than fourfold over the past 20 years. In 2012-13 students borrowed $110 billion for higher education (Baum, 2013). By comparison, students borrowed only $24 billion in 1990-91 (both figures are in 2012 dollars).

One fundamental reason for the aggregate increase in student debt is that there are more students in higher education. Enrollment has increased 62% over the past 20 years, from 9.8 million full-time equivalent students to 15.9 million (Baum, 2013).2 But accounting for enrollment growth still leaves much of the growth in student debt unexplained. Annual borrowing per full-time equivalent student nearly tripled from $2,485 in 1990-91 to $6,928 in 2012-13.

This analysis focuses on which college students are borrowing and whether the income background of borrowers has changed over the past two decades. The oft-written presumption is that low-income students are most likely to borrow and most dependent on loan programs.3 While this remains true, the new Pew Research Center analysis shows that, in recent decades, the balance has shifted significantly toward students from more affluent families.

In addition, the gender patterns of student borrowers are changing. This analysis concentrates on the student debt of those finishing bachelor’s degrees. One of the more noteworthy demographic trends of recent decades has been the rising share of women finishing four-year college degrees. Starting around 1980, females graduating high school began to eclipse their male counterparts in completing bachelor’s degrees, and the gap has since widened (Goldin, Katz, and Kuziemko, 2006). Since women increasingly make up the college graduate population, this suggests that more and more of the debt is owed by women. And, aside from change in the gender composition of college graduates, this analysis also shows that there are now gender differences in borrowing behavior that result in women owing more of the debt.