The detailed snapshot of adults ages 30-44 by their partnership status utilizes the U.S. Census Bureau’s 2009 American Community Survey (ACS). The ACS is a 1% sample of all U.S. households and features a very large sample of the population. The University of Minnesota Population Center’s Integrated Public Use Microsample (IPUMS) version of the 2009 ACS was analyzed (documentation available at http://usa.ipums.org/usa/index.shtml ). The ACS does not have a direct question as to whether a respondent has an unmarried partner. Cohabiting adults must instead be identified on the basis of a respondent’s relationship to the household head. A respondent may identify as the “unmarried partner of the head.” In the ACS one can thus identify “unmarried partners of the head” and their corresponding cohabiting household heads. Some cohabiting adults are thus not identifiable in the ACS. One of the cohabiters must be the head of the household in order to be properly assigned “cohabitation status.” As discussed below, other Census Bureau data reveal that about 80% of cohabiting adults are either the unmarried partner of the head or a cohabiting head of the household.

A primary purpose of this analysis is to compare the economic well-being of cohabiting adults ages 30-44 with their married counterparts. In this data source, marriage applies only to spouses of the opposite sex and to have a straightforward comparison of married to cohabiting persons, “cohabitation” is defined herein as opposite-sex cohabitation. Although fewer than one-in-ten adults is in an opposite-sex cohabiting relationship at a moment in time, the large size of the ACS results in the analysis being based on 35,929 opposite-sex cohabiting 30- to-44-year-olds.

In the ACS, income and poverty measures are available only for persons residing in households, so this analysis excludes all others, including those residing in group quarters. It should be noted that the poverty measure utilizes the University of Minnesota Population Center’s Integrated Public Use Micro Sample (IPUMS) version of the 2009 American Community Survey. Although the IPUMS poverty variable defines poverty on the basis of detailed family income and family structure information for each adult, it is not identical to the poverty variable on the original Census PUMS file. See http://usa.ipums.org/usa-action/variables/POVERTY for details.

The analysis is restricted to adults at least 30 years old because many younger adults are still in the process of completing their education. By age 30, most persons have finished their formal education. We imposed an upper age limit of 44 because partnership status may have different implications among older adults than adults in their family-forming years. After a certain age, most children no longer reside with their parent(s). Although 44 is admittedly arbitrary, the ages of 30-44 correspond to the key family-forming and child-rearing years of adulthood.

Although the analysis is restricted to 30-to-44 year-olds, this does not imply that a 30- to 44-year-old’s spouse or cohabiting partner also must be in that age group. Many people partner with persons older or younger than themselves. That the partner need not be 30-44 explains why the partner’s characteristics do not always match precisely the characteristics of partnered 30- to 44-year-olds. As an example, 80% of married 30- to 44-year-old adults were employed in 2009. If the 30- to 44-year-olds were all married to each other, then 80% of the spouses of 30- to 44-year-olds would have been employed. The actual share is slightly different: 79% of the spouses of married 30-to 44-year-olds had jobs because some of the married 30- to 44-year-olds have spouses outside the 30-44 age range.

Although the analysis is restricted to 30-to-44 year-olds, this does not imply that a 30- to 44-year-old’s spouse or cohabiting partner also must be in that age group. Many people partner with persons older or younger than themselves. That the partner need not be 30-44 explains why the partner’s characteristics do not always match precisely the characteristics of partnered 30- to 44-year-olds. As an example, 80% of married 30- to 44-year-old adults were employed in 2009. If the 30- to 44-year-olds were all married to each other, then 80% of the spouses of 30- to 44-year-olds would have been employed. The actual share is slightly different: 79% of the spouses of married 30-to 44-year-olds had jobs because some of the married 30- to 44-year-olds have spouses outside the 30-44 age range.

The trend analysis utilizes the Census Bureau’s March Current Population Survey (CPS). For the study of current partnerships, the CPS has two disadvantages relative to the ACS. 5

First, the CPS is a much smaller sample. For example, the March 2009 CPS has about 208,000 person records, about 1/15th the size of the 2009 ACS.

Second, the Census Bureau does not edit the CPS in the same fashion as the ACS. Until 2007, the CPS did not have a direct question on whether a person had a partner in the household. Beginning in 1995, an individual could identify oneself as the unmarried partner of the household head. However, in some households in the CPS several persons identify themselves as the unmarried partner of the head. Furthermore, in some households in which a person claims to be the unmarried partner of the head, the head of the household reports being married and living with a spouse. In this analysis we ignored these anomalies by identifying as cohabiting individuals only those persons who were the unmarried partners of the head of the household (and the head reported being unmarried); who lived in households with only one person claiming to be the unmarried partner of the head.

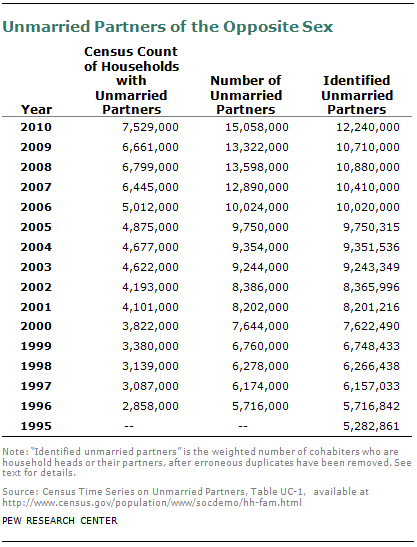

The table on page 26 reports the official U.S. Census Bureau tally of the number of cohabiting persons of all ages from the March Current Population Survey. It also reports the weighted number of cohabiting persons using the above procedures to identify cohabiters. In every year until 2007 we identify nearly 100% of cohabiting persons.

There is a break in the Census Bureau series at 2007. Beginning in 2007, cohabiters are identified using a direct question on cohabitation so all cohabiting relationships are identified, not just those involving the head of the household. Comparing our estimates in column 4 with the census count in column 3 reveals that cohabiting relationships involving the head of the household account for about 80% of all cohabiters. The analysis in the text uses the consistent time series reported in column 4 so that we have a consistent set of cohabiting persons across the years.

Tabulations from the March 2010 CPS indicate that the qualitative conclusions on economic well-being and cohabitation are robust to the manner in which cohabiters are identified. The first row of the table below identifies cohabiting persons on the basis of the more narrow unmarried partner of the household head. Cohabiters not involving the household head are enumerated with persons not residing with a spouse or partner. This mimics the identification procedure utilized for the American Community Survey, and college-educated cohabiters have a higher median adjusted household income than their married counterparts. The second row uses the more inclusive direct CPS question on cohabitation, and cohabiters in relationships not involving the household head are tallied as cohabiters rather than persons not residing with a spouse or partner. Cohabiters in relationships not involving the household head in 2010 tended to have lower adjusted household income than cohabiters involving the household head, but they also had higher household income than adults without a spouse or partner. Hence including cohabiters not involving the household head lowers the measured income status of cohabiters but also lowers the income status of single adults as well.

Household income data reported in this study are adjusted for the number of persons in a household. That is done in recognition of the reality that a four-person household with an income of, say, $50,000 faces a tighter budget constraint than a two-person household with the same income.

Household income data reported in this study are adjusted for the number of persons in a household. That is done in recognition of the reality that a four-person household with an income of, say, $50,000 faces a tighter budget constraint than a two-person household with the same income.

At its simplest, adjusting for household size could mean converting household income into per capita income. Thus, a two-person household with an income of $50,000 would be acknowledged to have more resources than a four-person household with the same total income. The per capita income of the smaller household would be $25,000, double the per capita income of the larger household.

A more sophisticated framework for household size adjustment recognizes that there are economies of scale in consumer expenditures. For example, a two-bedroom apartment may not cost twice as much to rent as a one-bedroom apartment. Two household members could carpool to work for the same cost as a single household member, and so on. For that reason, most researchers make adjustments for household size using the method of “equivalence scales” (Garner, Ruiz-Castillo and Sastre, 2003, and Short, Garner, Johnson and Doyle, 1999).

A common equivalence-scale adjustment is defined as follows:

Adjusted household income = Household income / (Household size)0.5

By this method, we are effectively assuming that a two-person household needs 1.41 times the income of a one-person household to be as equally well-off. Similarly, a four-person household requires twice the income of a one-person household to have equal resources.

Once household incomes have been converted to a “uniform” household size, they can be scaled to reflect any household size. The income data reported in this study are computed for three-person households.