College students who graduated in 2008 borrowed substantially more than students who graduated in 1996. In 2008, bachelor’s degree recipients borrowed $15,425 on average, compared with $10,138 for 1996 graduates. Borrowing by associate’s degree and undergraduate certificate recipients doubled, to $6,649 in 2008 on average from $3,318 in 1996 (all figures expressed in 2008 dollars).

College students who graduated in 2008 borrowed substantially more than students who graduated in 1996. In 2008, bachelor’s degree recipients borrowed $15,425 on average, compared with $10,138 for 1996 graduates. Borrowing by associate’s degree and undergraduate certificate recipients doubled, to $6,649 in 2008 on average from $3,318 in 1996 (all figures expressed in 2008 dollars).

Three trends contribute to the increase in average borrowing by students: a greater share of students is choosing to borrow; students who borrow are borrowing larger amounts; and students are attending a different mix of schools.3

Three trends contribute to the increase in average borrowing by students: a greater share of students is choosing to borrow; students who borrow are borrowing larger amounts; and students are attending a different mix of schools.3

More Borrowers

Students in the class of 2008 were more likely to borrow than were graduates in 1996, regardless of what type of school they attended. Overall, 60% of degree recipients in 2008 borrowed, compared with 52% in 1996. The largest increase (18 percentage points) occurred at private for-profit schools, where 95% of 2008 graduates borrowed, compared with 77% of 1996 graduates. The share of graduates who borrowed also increased at private not-for-profit schools (from 59% to 72%) and public schools (46% to 50%).

Larger Loans

For students who chose to borrow, the amount borrowed also gradually increased between the class of 1996 and the class of 2008. For every type of degree and type of school with reliable data, borrowers who graduated in 2008 had significantly more debt than did those who graduated in 1996. Among borrowers, the average debt for bachelor’s degree recipients increased 36%, from $17,075 in 1996 to $23,287 in 2008; the average debt for associate’s degree recipients increased 72%, from $7,751 to $13,321; and the average debt for certificate awardees increased 57%, from $7,300 to $11,427.

Types of Degrees and Types of Schools

This report examines borrowing by college students at three types of institutions: public, private not-for-profit and private for-profit.

Public schools graduated 2 million students in 2009. Among students who attended public schools, about 85% of associate’s degree and certificate recipients attended community colleges.

Private not-for-profit schools awarded 575,000 credentials in 2009, 18% of all undergraduate awards. Private not-for-profit schools are predominantly active in the bachelor’s degree market—they account for only 5% of associate’s degrees and certificates.

Private for-profit schools awarded roughly the same number of credentials, 574,000, as private not-for-profit schools. They primarily grant associate’s degrees and undergraduate certificates but are expanding rapidly into the bachelor’s degree market. For-profit schools often operate networks of schools; examples include the University of Phoenix, Strayer University, Kaplan Higher Education and DeVry University. In 2009, the University of Phoenix Online was the largest individual for-profit grantor of bachelor’s degrees (more than 14,500) and associate’s degrees (more than 12,000).

Students may be enrolled in one of three major degree programs: bachelor’s degrees, associate’s degrees and certificates. Although much attention is focused on bachelor’s degree students, half of the undergraduate credentials awarded annually—1.6 million of a total of 3.2 million—are for associate’s degrees or certificates. Associate’s degrees may typically be completed with two years of full-time course work, although many students take longer to graduate. A significant portion of associate’s degree recipients transfers the credits earned toward a bachelor’s degree program after graduation (Berkner & Choy, 2008). Certificates tend to be career-focused, ranging from trade certifications for truck drivers, home health workers, bar-tenders or massage therapists to credentials in computer network administration or construction management. Requirements for certificates vary from a few courses to as many as three or four years of full-time study.

Expansion of Private for-Profit Schools

The overall increase in borrowing is also driven by the shift of the student population to private for-profit schools. These schools granted 18% of all undergraduate credentials in 2009, up from 14% in 2003.4 The for-profit sector is expanding rapidly, awarding 172% more bachelor’s degrees, 61% more associate’s degrees and 36% more certificates in 2009 than in 2003. The total number of undergraduate awards granted by all schools has grown 22% in the same time period, with much more rapid growth at private for-profit schools (53%) than at public schools (18%) or private not-for-profit schools (10%).

Students at private for-profit schools both take out larger loans and are more likely to borrow than students seeking similar degrees at public or private not-for-profit schools.5 More than nine-in-ten (95%) graduates of for-profit schools in 2008 took out at least one loan. In contrast, half of 2008 graduates of public institutions and 72% of graduates at private not-for-profit schools decided to borrow. These differences may be attributable to a variety of factors, including that for-profit schools generally have higher costs of attendance, offer a different mix of fields of study, have different institutional practices (GAO, 2010) and serve different types of students.

High-Debt Borrowers

College borrowing is a mixed blessing. On the one hand, access to student credit may be an important factor facilitating college access for lower-income and non-traditional students. On the other hand, individuals with large student debt relative to their incomes may have difficulty making monthly payments.6

College borrowing is a mixed blessing. On the one hand, access to student credit may be an important factor facilitating college access for lower-income and non-traditional students. On the other hand, individuals with large student debt relative to their incomes may have difficulty making monthly payments.6

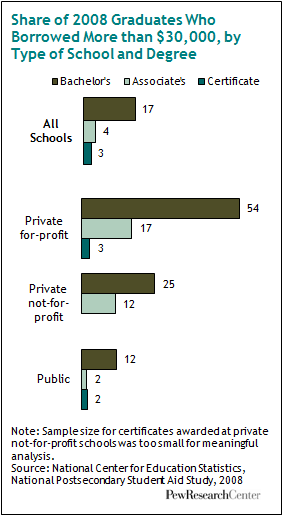

There is no clearly defined limit for what constitutes an acceptable level of student debt.7 Ease of repayment depends on future income and the repayment terms of the loan. Roughly one-in-ten graduates in 2008 borrowed more than $30,000. With standard loan terms, a student with $30,000 in debt will owe monthly payments of about $350 for 10 years.8 A small fraction of certificate and associate’s degree recipients borrow at this level (3% and 4%, respectively), but one-in-six (17%) of all bachelor’s degree recipients do. By type of school, 12% of bachelor’s degree recipients in public schools borrowed more than $30,000, compared with 25% at private not-for-profit schools and 54% at for-profit schools.

The lesser amount of borrowing by associate’s degree and certificate recipients is not surprising. Associate’s degrees and most undergraduate certificates require less course work and may be completed more quickly than bachelor’s degrees. Furthermore, graduates of these programs typically earn less over the course of their careers than do graduates with bachelor’s degrees. In the remainder of this report, bachelor’s degree recipients who borrowed more than $40,000 are regarded as high-debt borrowers and a lower bar—$20,000—is used for graduates below the bachelor’s degree level.