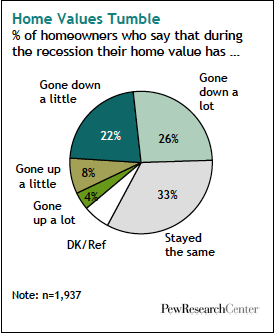

The Housing Bubble Bursts: About half of all homeowners (48%) say the value of their house has declined during the recession (26% say “a lot,” and 22% say “a little”). A third say their homes have held their value during the recession, and one-in-eight say their homes have increased in value. Homeowners most likely to report their home lost value include those who are middle-aged, upper income and live in the West. Also, Republicans (52%) are more likely than Democrats (42%) to say their house has lost value.

The Housing Bubble Bursts: About half of all homeowners (48%) say the value of their house has declined during the recession (26% say “a lot,” and 22% say “a little”). A third say their homes have held their value during the recession, and one-in-eight say their homes have increased in value. Homeowners most likely to report their home lost value include those who are middle-aged, upper income and live in the West. Also, Republicans (52%) are more likely than Democrats (42%) to say their house has lost value.

“Underwater”: More than two-in-ten (21%) of all homeowners say they currently owe more on their mortgage or other home loans than they could sell their house for in today’s market. In real estate vernacular, they are “underwater.” Hispanic and black homeowners are more likely than whites to be in this circumstance; lower-income homeowners are more likely than upper-income homeowners to face this problem, and middle-aged homeowners more likely than either younger or older homeowners to be in this situation.

Not Coming Back Anytime Soon: Among those who say their houses have lost value during this recession, the overwhelming majority believe it will take at least three years for values to return to pre-recession levels. This includes 47% who say they expect it will take three to five years and 39% who say it will take six years or longer. Just 10% say they expect a recovery in two or less years. Despite this, eight-in-ten Americans agree that a house is the best long-term investment the average person can make. (However, the share who “strongly agree” with this statement is just 39% now, down by 10 percentage points from the share who said the same in a 1991 survey.)

Not Coming Back Anytime Soon: Among those who say their houses have lost value during this recession, the overwhelming majority believe it will take at least three years for values to return to pre-recession levels. This includes 47% who say they expect it will take three to five years and 39% who say it will take six years or longer. Just 10% say they expect a recovery in two or less years. Despite this, eight-in-ten Americans agree that a house is the best long-term investment the average person can make. (However, the share who “strongly agree” with this statement is just 39% now, down by 10 percentage points from the share who said the same in a 1991 survey.)