The wealth of immigrant households in the United States increased sharply during the coronavirus pandemic, benefiting from broad gains for households overall. Yet immigrant households continue to lag far behind those headed by the U.S. born in terms of their overall wealth.

Here are five key facts about the wealth of immigrant households during the pandemic, based on the latest data from the Census Bureau’s Survey of Income and Program Participation (SIPP).

Pew Research Center conducted this study to understand how the wealth of U.S. households changed during the coronavirus pandemic. In this analysis, we emphasize how the financial impact varied within and across immigrant generations. Please refer to the methodology for more details.

Households are assigned demographic characteristics based on the characteristics of the survey reference person for each household. For example, if the survey reference person is an immigrant who identifies as Hispanic, then their household is a Hispanic immigrant household.

This analysis is based on data from the U.S. Census Bureau’s 2020 and 2022 Surveys of Income and Program Participation (SIPP), the latter being the latest available. SIPP collects detailed information on the economic and demographic characteristics of U.S. households. It is one of few surveys that report on the values of assets and liabilities (debt) held by households. SIPP offers much larger sample sizes than other surveys of household wealth. Respondents are asked to provide estimates of their asset values and debt holdings in December of the preceding year.

Household wealth or net worth is the value of assets owned by every member of the household minus their debt. The terms are used interchangeably in this report.

U.S. born refers to individuals who are U.S. citizens at birth, including people born in the United States, Puerto Rico or other U.S. territories, as well as those born elsewhere to parents who are U.S. citizens.

Foreign born and immigrants refer to individuals who are not U.S. citizens at birth.

U.S. born, parent(s) are foreign born refers to people born in the 50 states or the District of Columbia, Puerto Rico or other U.S. territories with at least one immigrant parent.

U.S. born, all others refers to people born in the 50 states or the District of Columbia, Puerto Rico or other U.S. territories, with no immigrant parents.

Related: Wealth Surged in the Pandemic, but Debt Endures for Poorer Black and Hispanic Families

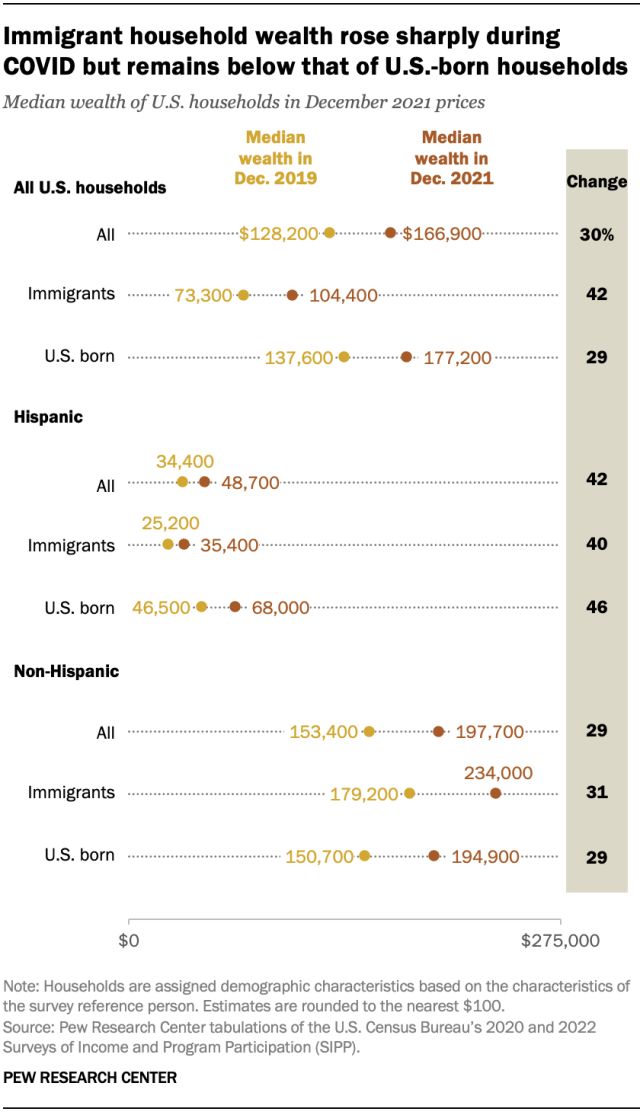

The median wealth of immigrant households increased by 42% from December 2019 to December 2021. Meanwhile, the median wealth of U.S.-born households increased by 29%.

Nonetheless, in 2021, immigrant households had much less wealth than those headed by a U.S.-born person, $104,400 vs. $177,200. This gap was not significantly different from that in 2019. (Dollar amounts are expressed in December 2021 prices.)

Household wealth in the U.S. also varies depending on whether the head of the household is Hispanic or not.

Among Hispanics, households headed by an immigrant had a median net worth of $35,400 in 2021, the lowest among the groups analyzed. Those headed by a Hispanic person born in the U.S., by comparison, had a median net worth of $68,000.

Among non-Hispanics, immigrant households had a net worth of $234,000 in 2021, and U.S.-born households held $194,900. Most non-Hispanic immigrant households trace their origins to Europe and Asia and have higher levels of education and income than other immigrants. As a result, they have some of the highest levels of wealth among U.S. households.

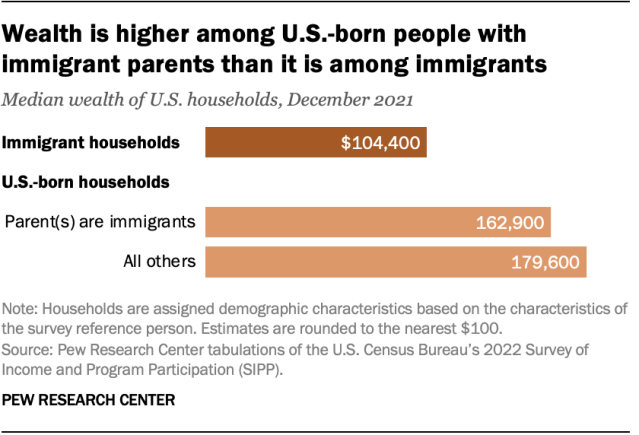

Household wealth is much higher among U.S.-born people with immigrant parents than among immigrants themselves, suggesting that wealth accumulation is largely completed within one immigrant generation. The median net worth of U.S.-born people with immigrant parents was $162,900 in 2021, compared with $104,400 among all immigrant households. Their median wealth, in fact, was nearly on par with that of all other U.S.-born people ($179,600).

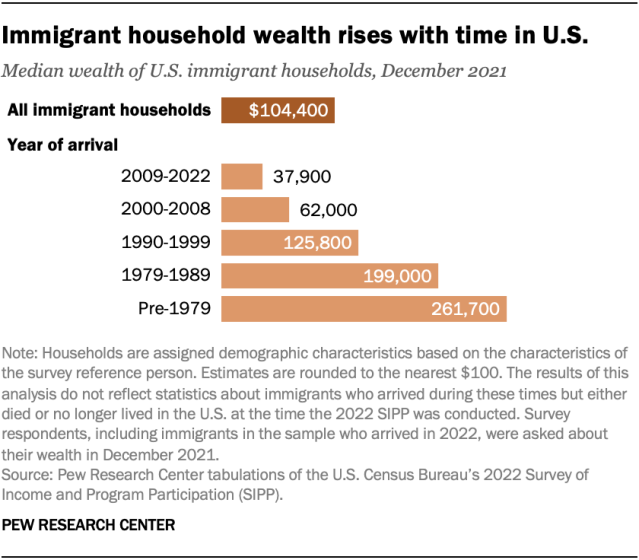

The longer an immigrant has been in the U.S., the more wealth their household typically has. Immigrants who arrived in the U.S. before 1979 had a median wealth of $261,700 in 2021 – almost seven times the median wealth of immigrants who arrived in 2009 or later.

This is partly because it takes time to accumulate wealth, beyond what may be inherited. It also suggests that economic mobility is not just for the children of immigrants; immigrants themselves see gains in wealth the longer they live in the U.S.

It should be noted that immigrants who came to the U.S. decades ago are less likely to be Black, Hispanic or Asian. In 1980, about half of immigrants (49%) identified as White alone and not Hispanic. In 2018, just 18% identified the same way. Thus, some of the differences in the wealth of immigrants by year of arrival may reflect these differences in origins and demographics.

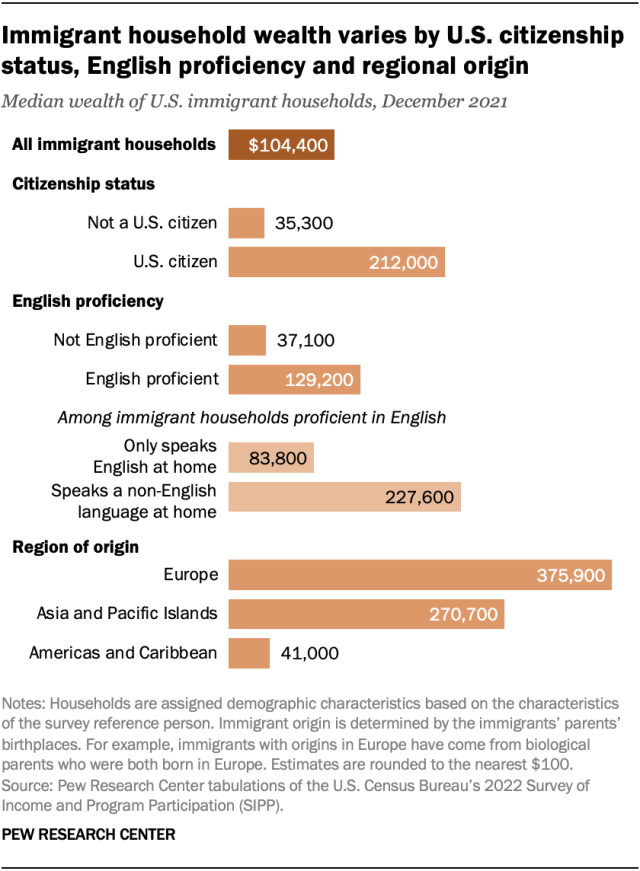

U.S. citizenship and proficiency in English are among the key attributes of immigrants with higher levels of wealth, while region of origin also plays a role. Those with U.S. citizenship had much greater wealth than noncitizens in 2021, $212,000 vs. $35,300. Similarly, those who reported being proficient in English had about three times as much wealth as those who were not English proficient, $129,200 vs. $37,100.

There are also notable differences by region of origin. The typical European immigrant household had $375,900 in wealth in 2021, while the typical Asian or Pacific Islander immigrant household had $270,700. Both groups had far more wealth than the typical household headed by an immigrant with origins in the Americas or Caribbean ($41,000).

There are a few reasons for these wealth disparities. One is time spent in the U.S.: European immigrants are likely to have lived in the U.S. longer, giving them more time to accumulate wealth. Another is the higher levels of education and income that immigrants from Europe and Asia tend to have.

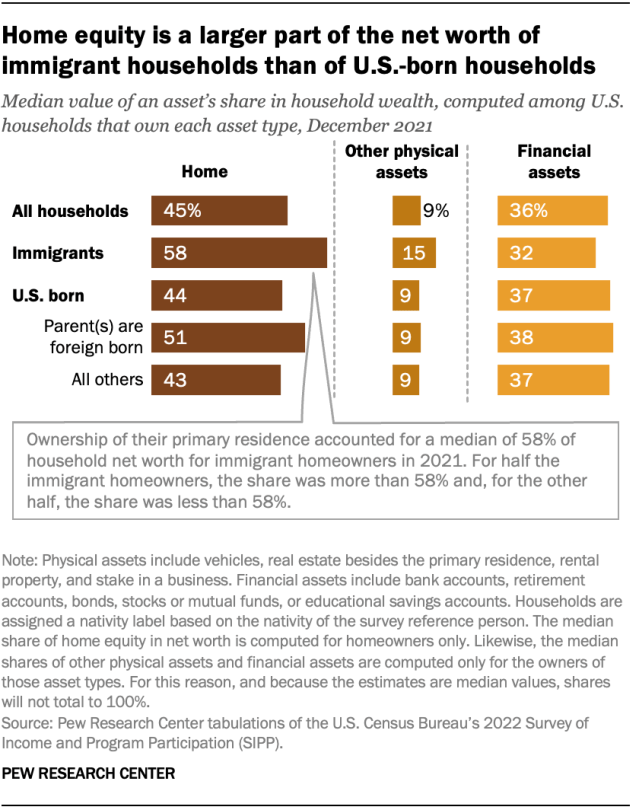

Home equity makes up a larger share of the typical immigrant household’s wealth than it does for other households. For immigrant households that owned their primary residence in 2021, home equity made up more than half (58%) of their household wealth. For U.S.-born households that owned their home, the share was 44%. At the same time, just half of immigrant households owned their home, while 64% of U.S.-born households did.

Overall, the typical immigrant household that owned physical assets in 2021 – such as a vehicle or rental properties – had a larger share of its wealth in those assets than the typical U.S.-born household did (15% vs. 9%). Immigrant households that owned financial assets, such as a retirement account or stocks and bonds, had less of their wealth in those assets than the U.S. born did (32% vs. 37%).