From books to dating, many aspects of life have gone digital, and wallets are no exception. Today, many Americans use the internet and smartphones to transfer money to friends, family and businesses. And while users praise these platforms for making paying for things easier, they also express concerns about security and privacy, according to a new Pew Research Center survey.

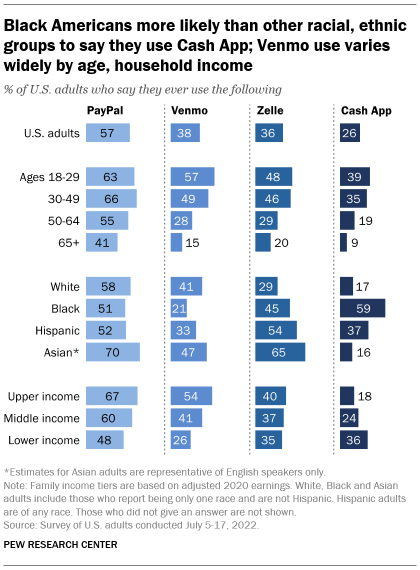

PayPal – which was founded more than two decades ago – is used by a majority of U.S. adults (57%). Smaller shares report ever using Venmo (38%) or Zelle (36%) and about one-quarter (26%) say they have ever used Cash App, according to the survey, which was conducted July 5-17. In total, 76% of Americans say they have ever used at least one of these four payment sites or apps.

Across each of the platforms measured in the survey, adults under 50 have adopted these tools at higher rates. But the starkest age gap relates to Venmo: 57% of 18- to 29-year-olds report using Venmo, compared with 49% of those ages 30 to 49 and smaller shares among those 50-64 (28%) and 65 and older (15%).

Pew Research Center conducted this study to better understand Americans’ experiences with and attitudes about payment apps and websites. This survey was conducted among 6,034 U.S. adults from July 5-17, 2022. This included 4,996 respondents from the Center’s American Trends Panel (ATP), an online survey panel that is recruited through national, random sampling of residential addresses. This way nearly all U.S. adults have a chance of selection. It also included an oversample of 1,038 respondents from Ipsos’ KnowledgePanel. The survey is weighted to be representative of the U.S. adult population by gender, race, ethnicity, partisan affiliation, education and other categories. Read more about the ATP’s methodology. Here are the questions, responses and methodology used for this analysis.

This survey includes a total sample size of 234 Asian adults. The sample primarily includes English-speaking Asian Americans and, therefore, may not be representative of the overall Asian adult population. Despite this limitation, it is important to report the views of Asian Americans on the topics in this study. As always, Asian adults’ responses are incorporated into the general population figures throughout this report. Because of the relatively small sample size and a reduction in precision due to weighting, we are not able to analyze Asian adults by demographic categories, such as gender, age or education.

In this analysis, payment app or site users refers to respondents who say they have ever used PayPal, Venmo, Zelle or Cash App. The specific platforms asked about are not an exhaustive list but are meant to measure a range of apps or websites that people may use for purchases or to transfer money.

Use of specific payment apps or websites also varies widely by race and ethnicity. For example, 59% of Black Americans say they ever use Cash App, compared with 37% of Hispanic Americans and even smaller shares of White (17%) or Asian Americans (16%). By contrast, Black adults are less likely than other racial or ethnic groups to report being a Venmo user.

There are also differences by household income. Adults with upper incomes are more likely than middle- and lower-income adults to be users of Venmo or PayPal. In contrast, lower-income adults are the most likely to say they use Cash App: About 36% say this, compared with 24% of middle-income and 18% of upper-income adults.

Why Americans do – or don’t – use these payment sites or apps

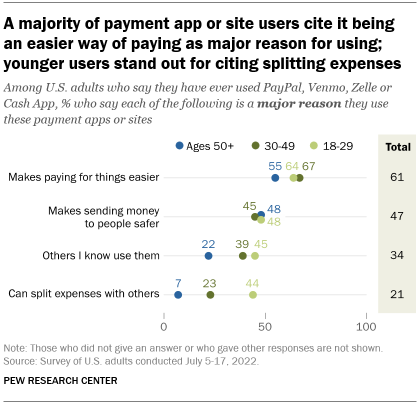

When asked what motivates them to use these sites or apps, users most frequently point to ease. Roughly six-in-ten Americans who have ever used PayPal, Venmo, Zelle or Cash App (61%) say a major reason for doing so is because it makes paying for things easier.

About half of these users (47%) say a key factor for using these platforms is because it makes sending money to people safer. Smaller shares say a major reason they use these platforms is that other people they know use them (34%) or that it allows them to split expenses with others (21%).

Reasons for using these tools vary by age. Some 44% of adults ages 18 to 29 who have used these payment sites or apps cite splitting expenses with others as a major reason, compared with 23% of those ages 30 to 49 and less than one-in-ten for those 50 and older. And users under 50 are more likely than those 50 and older to say a key factor is that other people they know use these sites or apps.

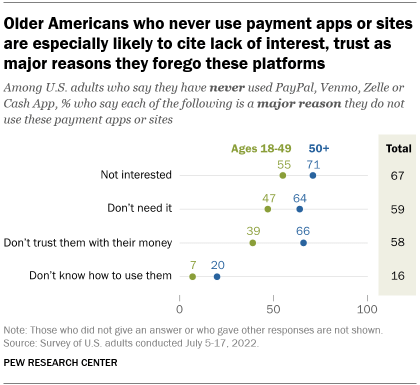

While there are a host of reasons why people gravitate toward these payment apps or sites, there is a segment of the public that has never used them. One of the most cited barriers is lack of interest: 67% of Americans who say they have never used PayPal, Venmo, Zelle or Cash App say not being interested is a major reason.

Those who do not have experience with these money-transferring platforms also point to a lack of necessity, as well as distrust. About six-in-ten non-users say a major reason for not using these payment apps or sites is because they don’t need them (59%) or because they don’t trust them with their money (58%). A much smaller share of this group (16%) cite lack of knowing how to use them as a major reason.

Distrust is a key hindrance for many older Americans. Two-thirds of Americans 50 and older who have never used these payment apps or sites say a major reason for not using them is that they do not trust these platforms with their money. That share drops to 39% among those 18 to 49.

This age pattern appears elsewhere, too: Older non-users are more likely than their younger counterparts to cite not needing these platforms, lack of interest or not knowing how to use them as major reasons why they do not use them.

Some lack confidence that payment apps or sites keep consumers’ personal information safe

As Americans have turned to digital options to purchase items or transfer money, concerns around security and hacking have followed. This has sparked a larger debate about the vulnerability of payment platforms and whether banks and payment app services have a responsibility to pay back consumers who have lost money due to fraud.

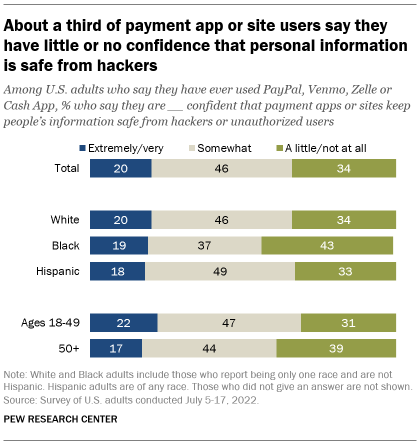

The Center’s new survey finds mixed views among users on whether these platforms can safeguard people’s information from bad actors. About one-third of payment app or site users (34%) say they are a little or not at all confident that payment apps or sites keep people’s personal information safe from hackers or unauthorized users.

By comparison, smaller shares of these payment app or site users (20%) say they are extremely or very confident these platforms keep people’s information safe from hackers or unauthorized users. The largest share (46%) report they are somewhat confident that payment apps or sites keep personal information away from hackers.

Black users are more skeptical than other groups: 43% say they are only a little or not at all confident that payment sites and apps keep personal information safe from hackers or unauthorized users, compared with about one-third of White or Hispanic users. (There were not enough Asian American payment app or site users to be broken out into a separate analysis.)

There are age differences as well. Adults 50 and older who have ever used these payment sites or apps are more likely than those 18 to 49 to describe their confidence level as a little or not at all confident (39% vs. 31%).

People who have never used these payment platforms are highly skeptical that these services keep users’ information secure. Roughly eight-in-ten Americans who have never used these payment app or sites say they have a little (20%) or no confidence at all (59%) that these services keep people’s information safe.

About one-in-ten payment app or site users say they have fallen victim to scams, hacking

Americans’ concerns about the safety of their personal data come as some users report personally being the target of scams or hacking.

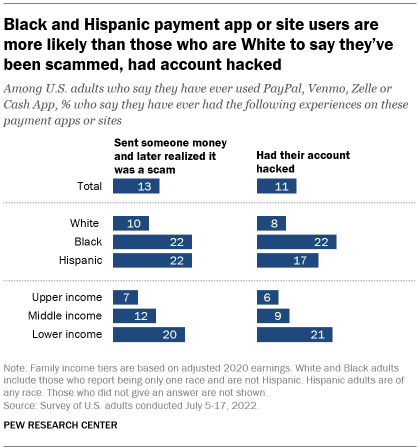

Some 13% of people who have ever used PayPal, Venmo, Zelle or Cash App say they have sent someone money and later realized it was a scam, while a similar share (11%) report they have had their account hacked.

These negative experiences are more prevalent among certain groups of users. Black and Hispanic Americans who use payment platforms (22% each) are about twice as likely as their White counterparts (10%) to say they have sent money to someone and later realized it was a scam. Black and Hispanic users are also more likely than White users to say they have had their account hacked.

There are also differences by household income. Some 20% of Americans with lower incomes who have ever used these payment apps or sites say they have been the target of this type of a scam, while a similar share say the same about having their account hacked while using these platforms, compared with about one-in-ten or fewer users from middle- or upper-income households. Modest age differences exist, too. For example, 18% of 18- to 29-year-old payment app or site users say they were scammed out of money they sent, compared with 12% of those 30 and older.

Note: Here are the questions, responses and methodology used for this analysis.

Read more from our series examining Americans’ experiences with money, investing and spending in the digital age: