The more than 150 million workers in the United States include about 16 million workers who identify as self-employed. They work for profit or fees in their own enterprises and are a representation of America’s small business owners. Many also create jobs for other workers, on the order of about 30 million in recent years.

A new Pew Research Center analysis of government data finds that the COVID-19 recession, which curtailed business operations for public health reasons, had a similar impact on employment levels among both those who are and are not self-employed. However, the recovery has been stronger for self-employed workers. At the same time, hiring by the self-employed has fallen since 2019, with the cutbacks emanating mainly from businesses run by men.

Self-employment can be a gateway into the business world for the nation’s entrepreneurs. It can also be a desirable option for those wanting to be their own boss or in search of more flexible work hours. Some workers who lose their jobs in business downturns turn to self-employment, which has risen during recessions. In the coronavirus pandemic, it also may have been a useful option for some parents juggling child care and work.

To understand how the economic recession brought on by the COVID-19 pandemic impacted self-employed workers in the U.S. and their hiring activity, Pew Research Center analyzed data from the 2019, 2020 and 2021 Current Population Survey monthly files.

The CPS is the U.S. government’s official source for monthly estimates of unemployment. In this report, monthly CPS files were combined to create quarterly files to boost sample sizes for the self-employed. Estimates for the numbers of workers who are self-employed or not self-employed exclude those who are absent from work for any reason. This is done to better account for inactivity among the self-employed, who are not typically classified as unemployed, even if they lack for business.

For a quarter of the sample each month, the CPS also records the number of workers usually hired by self-employed workers in their businesses. For 2021, this data was only available for the months of February to August (the latest available at the time of this analysis). These seven months of data for 2021 were combined to increase sample size, and the process was repeated for 2019 and 2020 to eliminate the effect of seasonal variations on the estimated trends. Estimates of workers usually hired by the self-employed rest on a sample of self-employed workers that includes those who were absent from work.

The COVID-19 outbreak has affected data collection efforts by the U.S. government in its surveys, limiting in-person data collection and affecting the response rate. It is possible that some measures of labor market activity and how they vary across demographic groups are affected by these changes in data collection.

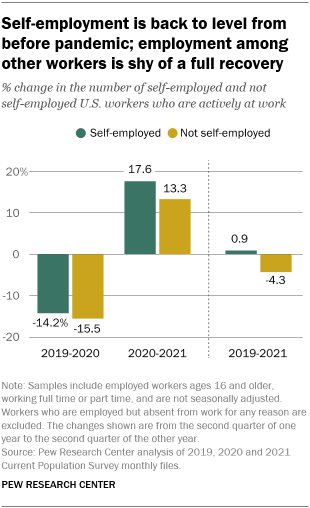

The number of self-employed workers actively at work – not absent for any reason – fell from 14.8 million in the second quarter of 2019 to 12.7 million in the second quarter of 2020, a decrease of 14.2%. Over the same period, the number not self-employed who were actively at work fell from 137.3 million to 115.9 million, a loss of 15.5%. Thus, the immediate impact of the recession, which lasted through March and April of 2020, was felt similarly by the self-employed and the rest of workers.

The number of self-employed workers actively at work rebounded strongly in the economic recovery, increasing by 17.6% from the second quarter of 2020 to the second quarter of 2021. This was sufficient to raise the number of self-employed to 14.9 million, restoring it to 2019 levels. However, employment among the remaining workers actively at work has not yet recovered to its pre-recession level, standing at 131.4 million in the second quarter of 2021 – still 5.9 million (4.3%) short of its level in 2019.

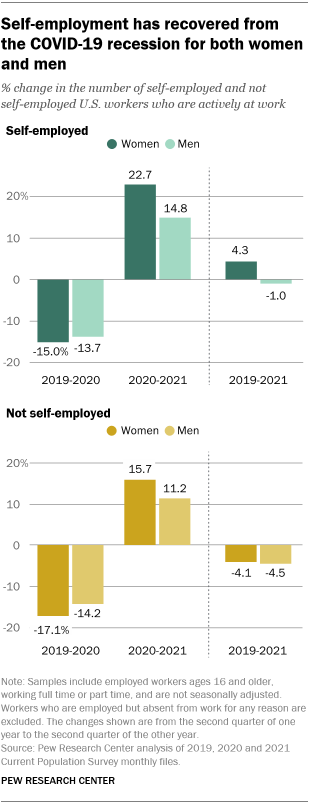

Changes in self-employment played out similarly among women and men, both of whom experienced sharp losses in employment in 2020 and notable gains in 2021. Some 5.2 million women were self-employed and actively at work in the second quarter of 2019, but the number fell to 4.4 million in the second quarter of 2020, a loss of 15.0%. Among men, self-employment dropped from 9.6 million in 2019 to 8.2 million in 2020, a loss of 13.7%. By the second quarter of 2021, the number of self-employed women and men had risen to 5.4 million and 9.5 million, respectively, about the same as in 2019 and marking a full recovery.

Among workers who are not self-employed but are actively at work, neither women nor men have returned to their pre-recession level of employment. Among women, the number stood at 62.8 million in the second quarter of 2021, down 2.7 million (4.1%) from the second quarter of 2019. Over the same period, men who are not self-employed have experienced a 4.5% drop in employment, from 71.8 million to 68.6 million.

Hiring of other workers by the self-employed

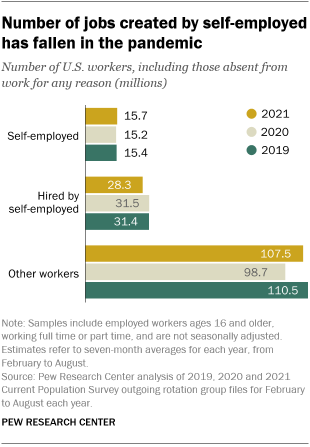

Self-employed workers and the businesses they run are a significant source of job creation. In 2019, the self-employed had 31.4 million employees on their payrolls. Altogether, the self-employed and their employees accounted for nearly 30% of total employment in the U.S. in 2019. That was about the same as their share of total employment in 2014, when the data first became available. But, after holding steady in 2020, the number hired by the self-employed fell in 2021 and currently stands below its level in 2019.

In 2020, self-employed workers reported having 31.5 million workers on their payrolls, about the same as in 2019. Meanwhile, the number of other workers in the economy – neither self-employed nor working for the self-employed – fell from 110.5 million to 98.7 million.

It is not entirely clear why employment in businesses run by the self-employed did not decrease during the recession. One reason might be that the Current Population Survey – the government survey that is the source of the estimate – asks about the “usual” number of employees on a self-employed worker’s payroll. Pending more permanent downsizing of their businesses, self-employed workers may not have reported a different level of hiring in 2020 than in 2019.

A delay in reporting downsizing might also be the reason why the payrolls of self-employed workers are estimated to have shrunk during the economic recovery, from 31.5 million in 2020 to 28.3 million in 2021, even as the employment of other workers increased from 98.7 million to 107.5 million. It is also possible that the recent increase in quit rates by workers has affected self-employed business owners more. Nonetheless, the self-employed and their employees still accounted for about 29% of total employment in 2021.

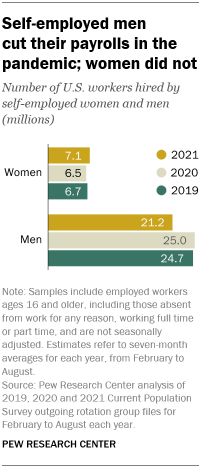

Self-employed men, who outnumber self-employed women, are also more likely to have employees. Factors that appear to drive this gender gap are differences in family obligations and the distributions of men and women across industries. In 2019, about 26% of self-employed men and 16% of self-employed women had payrolls. Moreover, among the self-employed with employees, men hired 9.4 workers on average in 2019, compared with 7.6 workers on average among women. Thus, men account for most of the hiring by the self-employed.

In 2019, self-employed men had a total payroll of 24.7 million employees and self-employed women had a payroll of 6.7 million. But the number of workers employed by self-employed men fell to 21.2 million by 2021, as these businesses cut hiring by about one worker each, on average. The number of workers hired by self-employed women remained steady and, if anything, appears to have risen during the pandemic, edging up to 7.1 million in 2021.

The reasons why self-employed men reduced hiring during the pandemic, but women did not, are not readily apparent. Self-employed men are more concentrated in construction, and self-employed women are more present in service-sector industries, such as personal care and laundry services. But overall employment trends in these two sectors have been similar during the course of the pandemic, with job losses in construction no more severe than the losses in service-providing industries. Unfortunately, sample size limitations in the source data do not permit a more detailed accounting of the gender differences in hiring trends among the self-employed.