Despite the severity of the shock to the U.S. labor market from the coronavirus pandemic, the earnings of employed workers overall were largely unaffected by the pandemic. Inequality in earnings did rise during last year’s recession, if the unemployed are assumed to have had no compensation. Even so, the spike was relatively short-lived, in keeping with the record low duration of the recession, according to a new Pew Research Center analysis of government data.

Earnings overall have held steady through the pandemic in part because lower-wage workers experienced steeper job losses. Thus, the typical employed worker in 2020 earned more than the typical employed worker in 2019. A slowdown in inflation in 2020 benefited all workers, boosting the purchasing power of their earnings. While unemployed workers lost their earnings, at least some relief came through unemployment insurance, a federal package known as the CARES Act and a moratorium on residential evictions.

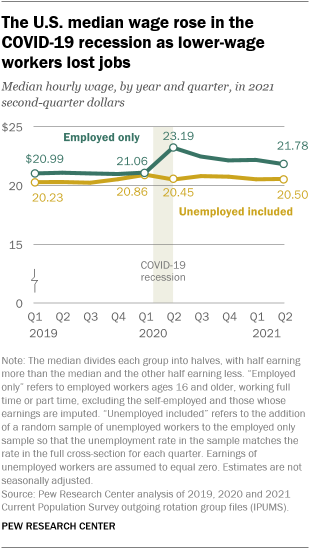

The median wage of employed U.S. workers had held steady at about $21 per hour for several calendar quarters before the coronavirus outbreak. With the unemployment rate hovering below 4% ahead of the COVID-19 recession, even if unemployed workers were included – at zero earnings – there was little effect on the estimated median wage, nudging it down to about $20 in 2019, but no more. (Wages are adjusted for inflation and expressed in 2021 second-quarter dollars.)

To understand how the economic recession brought on by the COVID-19 pandemic impacted the wages of U.S. workers, Pew Research Center analyzed data from the 2019, 2020 and 2021 Current Population Survey monthly files (IPUMS).

The CPS is the U.S. government’s official source for monthly estimates of unemployment. For a quarter of the sample each month, the CPS also records data on usual hourly earnings for hourly workers and usual weekly earnings and hours worked for other workers. In this report, monthly CPS files were combined to create quarterly files so as to boost sample sizes and to dampen the effects of month-to-month seasonal variations in the estimates.

Workers for whom earnings were imputed by the Census Bureau, about 18% of the overall sample, are excluded from the analysis. A random sample of unemployed workers was taken so that the unemployment rate for the final sample – those without imputed earnings plus the unemployed – was about the same as the unemployment rate in the sample including workers with imputed earnings. The creation and the analysis of the matched sample of workers was facilitated by the resources available in the IPUMS database and the guidance provided by the National Bureau of Economic Research (NBER).

The COVID-19 outbreak has affected data collection efforts by the U.S. government in its surveys, limiting in-person data collection and affecting the response rate. It is possible that some measures of labor market activity and how they vary across demographic groups are affected by these changes in data collection.

As the pandemic struck, lower-wage workers proved most likely to experience a job loss. The shift toward higher-wage workers among the employed helped to raise the median hourly wage to $23 in the second quarter of 2020. The median wage of all workers, including the unemployed, remained unchanged at about $20 per hour, likely because many workers who lost their job already earned less than the median.

The median wage for employed and unemployed workers combined has remained about the same since the end of the recession in April 2020. But the median wage among employed workers alone has drifted down since the second quarter of 2020 as the unemployment rate dropped and lower-wage jobs were partially restored. In the second quarter of 2021, employed workers’ median wage stood at about $22 per hour. It is possible that it may decrease further as employment in lower-wage jobs returns to pre-pandemic levels.

Although the change in the composition of employed workers toward higher-wage workers clouds the picture of how earnings have evolved during the pandemic, it is possible to gain insight by focusing on the change in earnings for the same workers over time. Federal household survey data used in this analysis records the earnings of many workers at two points in time a year apart. The sample of employed workers matched over time is a subset of the overall sample, which varies with the addition and departure of some survey respondents. It offers another view of how earnings changed during the COVID-19 recession and afterward.

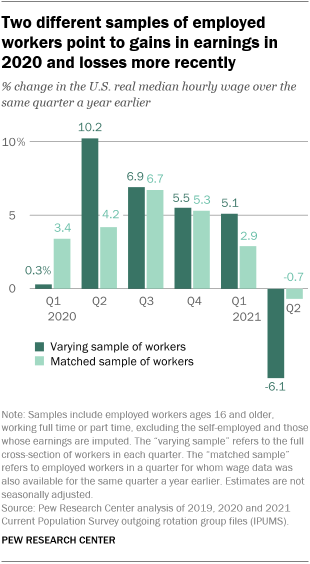

The median wage of the varying sample of employed workers – the full cross-section of workers by quarter – had risen to $23.19 in the second quarter of 2020. This represented an increase of 10.2% over the median wage in the second quarter of 2019. The median wage for the matched sample of employed workers – the same workers over time – also increased over this period, from $23.15 to $24.12, or by 4.2%. While both samples point to higher earnings in 2020 despite the onset of the pandemic, the much greater increase in the varying sample points to the sizable role played by the loss of lower-wage jobs in driving up the increase in the median.

Regardless of the sample, the earnings of employed workers in 2020 remained higher than in 2019, albeit less so with the passage of time. As the unemployment rate fell, the initial rise in the median wage of the varying sample of workers moderated through the course of 2020. By the fourth quarter of 2020, the earnings of employed workers in either sample were about 5.5% higher than in the fourth quarter of 2019. Nonetheless, despite the pandemic and an economic slowdown, most workers saw higher earnings in 2020.

Those gains proved fleeting, however. In the first quarter of 2021, the median wage of the matched sample of workers stood 2.9% higher than their wage in the first quarter of 2020. But, by the second quarter of 2021, the median wage of the matched sample was 0.7% less than it was a year earlier, and the median wage of the varying sample had fallen by 6.1%. The larger decrease for the varying sample is driven again by the changing composition of employed workers, this time shifting toward lower-wage workers.

The recent decline in wages, adjusted for inflation, is also partly due to an acceleration in the growth in U.S. consumer prices in 2021. Previously, consumer prices increased 1.4% from 2019 to 2020, compared with 2.3% from 2018 to 2019. This helped sustain higher earnings for workers in 2020. However, inflation has ticked up recently, with consumer prices registering an increase of 4.8% in the second quarter of 2021 compared with the second quarter of 2020. Thus, the earnings of workers have eroded in recent months, including for the matched sample of workers.

Earnings changed similarly for high- and low-wage workers from 2019 to 2021, leaving inequality unaffected

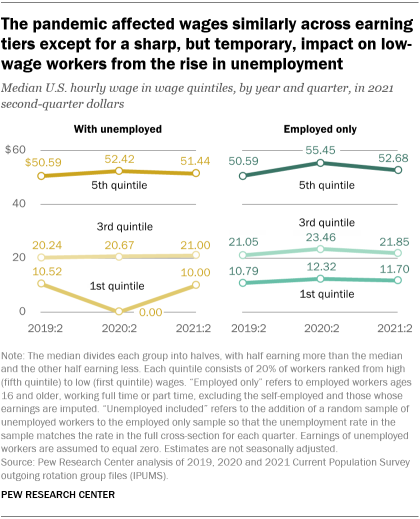

The earnings of low-wage workers – those in the first quintile of earners – and high-wage workers – those in the fifth quintile of earners – evolved similarly from 2019 to 2021. The sole exception is the drop in the median wage of the first quintile of earners in 2020 when the unemployed are retained in the sample.

Among the employed, the median wage of low-, middle- and high-wage workers all increased in the second quarter of 2020, followed by a gentle decline. Over the two-year period from the second quarter of 2019 to the second quarter of 2021, the median hourly wage of high-wage workers increased from $50.59 to $52.68 and the median for low-wage workers increased from $10.79 to $11.70. Overall, wages for the three earning tiers of employed workers are slightly higher in 2021 than in 2019.

Including the unemployed in the sample has a dramatic effect on the median earnings of low-wage workers, but relatively briefly. The median hourly wage of these workers fell from $10.52 in the second quarter of 2019 to $0.00 in the second quarter of 2020, followed by a rebound to $10.00 in the second quarter of 2021. As the U.S. unemployment rate reached near 13% in the second quarter of 2020, the unemployed – with zero earnings – comprised a majority of low-wage workers. Thus, the median wage of this group plunged to zero amid the recession, but then increased with the restoration of jobs.

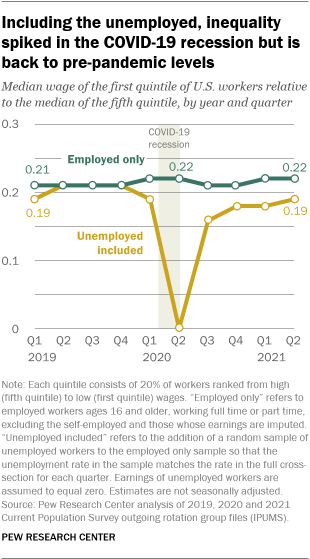

With the impact on the median earnings of low-wage workers being of limited duration, the pandemic also does not seem to have left a lasting imprint on income inequality. In 2019, the median earnings of low-wage workers were about 20% of the median earnings of high-wage workers. Among employed workers, this ratio budged little through the recession and in the period since, with low-wage workers earning 22% as much as high-wage workers in the second quarter of 2021.

Including the unemployed shows the potential for a widening of income inequality at the start of the pandemic. In the second quarter of 2020, low-wage workers earned nothing (0%) at the median compared with high-wage workers – or any other group, for that matter. But the wage ratio increased to 16% by the third quarter of 2020 and had ascended to 19% by the second quarter of 2021, comparable to the levels in 2019.

Overall, what happened to wage inequality during the COVID-19 recession depends to a large degree on what truly happened to the financial resources of unemployed workers. If the loss in wages was replaced by unemployment insurance, supplemental relief under the CARES Act, or by other means, there may have been no change in income inequality. But inequality may yet widen in the near future. Some 39% of the unemployed had been without work for six months or longer in July 2021. Evidence shows that these workers are likely to experience a loss in earnings as they find new jobs. Meanwhile, there is no guarantee of financial relief from the government beyond September.

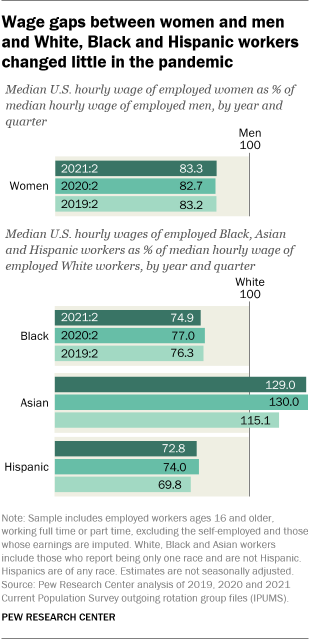

Inequality also manifests itself in the form of wage gaps between men and women and across racial and ethnic groups. Although unemployment initially increased more among women – to 14.1% in the second quarter of 2020 compared with 12.1% among men – it has fallen more quickly since, according to government estimates. The difference in the unemployment rate for women (5.7%) and men (6.1%) in the second quarter of 2021 is relatively small, as was the case before the pandemic. Likewise, there was virtually no movement in the gender wage gap, with employed women earning 83.3% as much as employed men at the median in the second quarter of 2021, about the same as in 2019. Indeed, the gender wage gap has held steady at this level since about 2005.

The earnings of employed Black and Hispanic workers relative to the earnings of employed White workers have also changed little during the pandemic. In the second quarter of 2021, Black workers earned 74.9% as much as White workers at the median, compared with 76.3% in the second quarter of 2019. For Hispanic workers, this ratio edged up from 69.8% to 72.8% over the same period.

The most notable change was among Asian American workers, who have historically earned more at the median than other racial and ethnic groups. In the second quarter of 2019, employed Asian workers earned 115.1% as much as employed White workers. This ratio jumped to 130.0% in the second quarter of 2020 and has since remained at about that level.

But the changes in relative earnings, especially for Asian workers, need to be viewed with caution. In the second quarter of 2021, the unemployment rate among U.S. Asian workers was 5.6%, more than double its level of 2.3% in the second quarter of 2019. The proportional increase in the unemployment rate – or in the number unemployed – for other racial and ethnic groups has been much less. This suggests that the composition of employed Asian workers may still lean more towards higher-wage workers than the composition of other employed workers.

Moreover, the median wage of Asian workers may be affected more than the median for other workers by the shift in who is employed. That is because the income ladder among Asian Americans is the steepest, with wide gaps in income among origin groups and more income inequality than among other groups. Since job losses by lower-wage workers essentially push the median wage up the earnings ladder, the group with the steepest ladder – Asian workers – is likely to have seen the biggest increase.

If the unemployed are included in the analysis, the estimated increase in the earnings of Asian workers relative to the earnings of White workers from 2019 to 2021 is cut in half. Instead of increasing by 14 percentage points – from 115.1 in 2019 to 129.0 in 2021 – the increase with unemployed workers included is 7 points. But including the unemployed has no effect on the estimated change in the earnings of Black and Hispanic workers relative to the earnings of White workers.