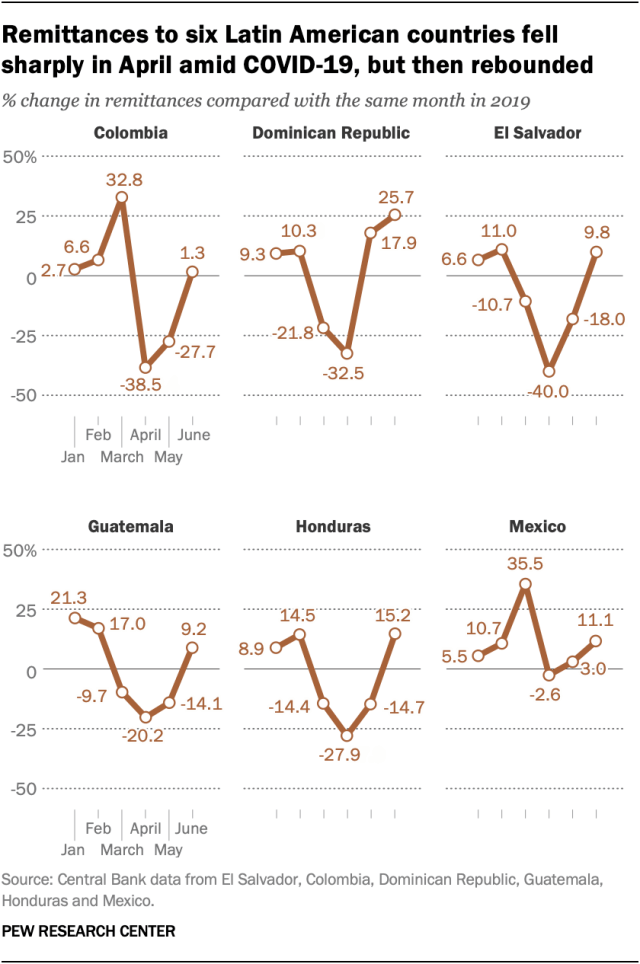

Remittances to several Latin American nations with close migrant ties to the United States declined sharply in the first half of 2020 – especially in April, when much of the U.S. was locked down due to the COVID-19 outbreak, according to a Pew Research Center analysis of data from their national central banks.

Across the six countries included in the analysis – Colombia, the Dominican Republic, El Salvador, Guatemala, Honduras and Mexico – remittances were 17% (or $981.2 million) lower in April 2020 than in April 2019. Most of these countries rely on the U.S. for the vast majority of their remittances. These nations also are the birthplaces of roughly eight-in-ten of the 20 million Latino immigrants who reside in the U.S.

Some Latin American countries were hit harder than others by this spring’s decline in remittances, or the money sent by migrants to their origin nations. El Salvador experienced a 40.0% drop in remittances in April 2020 compared with April 2019, the largest decline among the six nations analyzed. Remittances to Colombia declined by 38.5% during this time, the second-sharpest drop.

To examine changes in monthly remittances during the economic downturn caused by the COVID-19 pandemic, this analysis uses central bank data from the following countries: Bangladesh, Colombia, Dominican Republic, El Salvador, Guatemala, Honduras, Mexico and the Philippines. The analysis also uses global estimates of remittance flows from the World Bank.

Estimates of a nation’s emigrant population (except for the United States) are drawn from the United Nations publication “International migrant stock: The 2019 revision,” accessed on Aug. 3, 2020. For emigrants living in the U.S., data for 2018 is extrapolated from 2018 American Community Survey data.

The UN uses a taxonomy of nations and territories and classifies migrants born in territories and living elsewhere as international migrants, even if their citizenship is different from their territory of birth. For example, UN data counts people born in Puerto Rico, a U.S. commonwealth, as international migrants, even though they are U.S. citizens by birth. For this reason, some UN estimates of the foreign-born population shown here may differ from other estimates published by the U.S. Census Bureau or Pew Research Center.

Mexico experienced the smallest drop in remittances among the six countries in April, at 2.6%. In March, the country took in $4.0 billion, a record high for Mexico, up 35% from the previous year. The increase in March was partly driven by a favorable exchange rate between the Mexican peso and U.S. dollar; a rise in the number of individual remittance transactions (including electronic transfers and money orders); and an increase in the average amount sent in each remittance transaction.

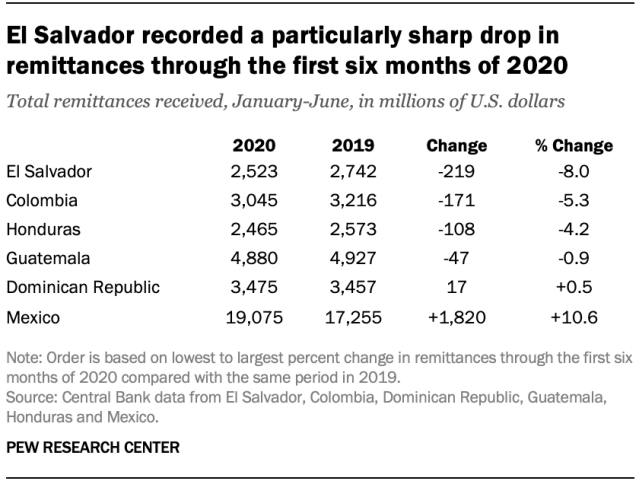

Overall, remittances during the first six months of 2020 remain below 2019 levels in four of the six nations: Colombia, El Salvador, Guatemala and Honduras. El Salvador had the largest drop during this period (-8.0%), followed by Colombia (-5.3%) and Honduras (-4.2%). The Northern Triangle nations of El Salvador, Guatemala and Honduras each experienced their largest percentage declines in remittances for the first half of any year since 2009, during the Great Recession, though total remittances currently remain well above 2009 levels. By contrast, Mexico and the Dominican Republic have received more remittances through the first six months of 2020 than in the same period in 2019 – up 10.6% and 0.5%, respectively.

Remittance flow data from countries in other regions also suggests a decline during the first six months of 2020 – as well as signs of a rebound. For example, remittances to the Philippines and Bangladesh, two countries that are among the world’s top origins of international migrants, were down 4.2% and 1.4%, respectively, compared with 2019, with especially sharp declines in April. But monthly remittances to both countries rebounded in June.

The decline in remittances through the first half of 2020 follows a record-setting year in 2019. Worldwide, remittances reached a new high of $714 billion in 2019, according to the World Bank. The six Latin American nations in this analysis each received record high remittances in 2019, and together took in $71.5 billion last year. These high levels continued into early 2020, with remittances in January and February exceeding 2019 totals in each of the six countries.

But as the COVID-19 outbreak surged across the globe this spring, remittances from the world’s nearly 272 million immigrants were projected to fall about 20% in 2020. The world’s top remittance-sending nations experienced especially long economic shutdowns, hampering the ability of immigrants to send money to their home countries, according to a June Pew Research Center analysis. The U.S. has by far the world’s largest immigrant population, and has been the top remittance-sending country in recent years by a wide margin.

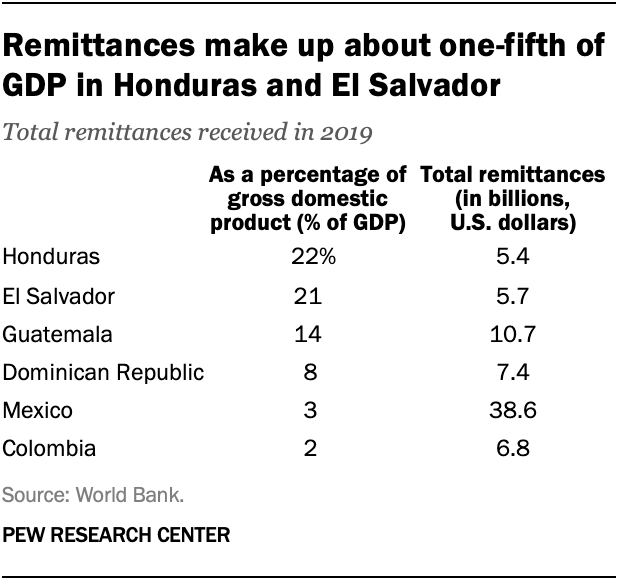

Remittances play an important role in the economies of some nations. In Honduras and El Salvador, for example, remittances accounted for more than 20% of GDP in 2019, among the highest shares in the world. Remittances were also a considerable share of GDP in Guatemala (14%) and Dominican Republic (8%) in 2019, and a lower share in Mexico (3%) and Colombia (2%).

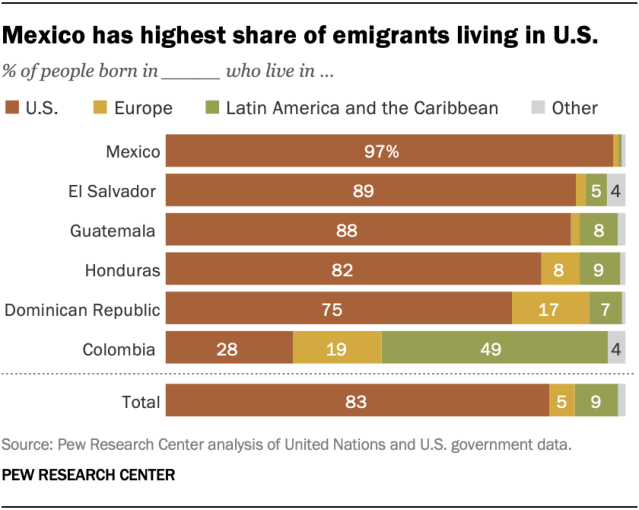

Most migrants from Mexico, El Salvador, Guatemala, Honduras and Dominican Republic live in the U.S.

As of 2019, the United States is home to roughly eight-in-ten international migrants (83%) who were born in the six Latin American nations in this analysis. By comparison, the U.S. is home to a smaller share of migrants (67%) from the broader Latin America and Caribbean region as of 2017.

Nearly all international migrants who were born in Mexico live in the U.S. (97%), the highest share among the six countries, followed by El Salvador (89%) and Guatemala (88%). By comparison, only around a quarter (28%) of international migrants born in Colombia live in the U.S.; a plurality (49%) live elsewhere in the Latin America and Caribbean region.