President Joe Biden recently signed into law new legislation that includes larger investments in renewable energy and measures to address climate change. Among its provisions is a 30% solar tax credit that could spur more Americans to “go solar” over the next decade.

While residential solar power currently generates just a fraction of the country’s overall electricity, it has continued to grow rapidly in recent years, despite COVID-19-related supply chain issues, import restrictions and other obstacles.

Residential solar power installations rose by 34% from 2.9 gigawatts in 2020 to 3.9 gigawatts in 2021, according to data from the U.S. Energy Information Administration (EIA), a government agency that collects and analyzes information about the energy industry. And in the second quarter of 2022, residential solar set its fifth consecutive quarterly growth record, according to the Solar Energy Industries Association.

Pew Research Center conducted this analysis to understand Americans’ adoption of home solar panels. It relies on data from the U.S. Energy Information Administration and the Solar Energy Industries Association, among other sources.

The analysis also draws from a Center survey of 10,237 U.S. adults conducted from Jan. 24-30, 2022. Everyone who took part in the survey is a member of the Center’s American Trends Panel (ATP), an online survey panel that is recruited through national, random sampling of residential addresses. This way, nearly all U.S. adults have a chance of selection. The survey is weighted to be representative of the U.S. adult population by gender, race, ethnicity, partisan affiliation, education and other categories. Read more about the ATP’s methodology.

Here are the questions used for this analysis, along with responses, and its methodology.

Even with the new federal tax credit – and other available incentives, including state tax incentives – home solar panels are expensive. The average installation cost of a residential solar panel system so far this year can range from $16,870 to $23,170 after applying the federal solar tax credit, according to EnergySage, though other factors, such as the type of solar panel, can affect the price. Supply chain constraints have also increased the cost of solar panels since the start of the COVID-19 pandemic.

Residential solar power still generates less electricity than large utility-scale solar, such as solar panel farms. And all solar power together generates only a small amount of the electricity used in the United States. In 2021, solar generated just 3% of all utility-scale electricity, a far smaller share than natural gas (38%) or coal (22%).

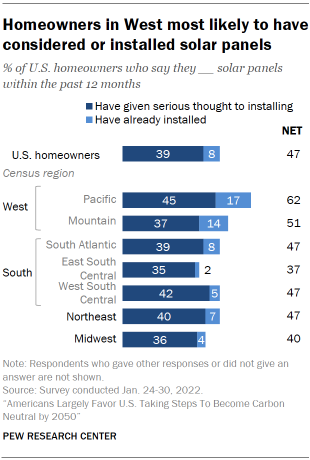

A January Pew Research Center survey found that 8% of U.S. homeowners said they have already installed solar panels and an additional 39% have given serious thought to it in the past year. The survey was conducted before the 30% federal tax credit became law in August.

The share of homeowners who say they have installed solar panels is up from 6% in a 2019 survey and 4% in 2016. But the share who said in January that they have given serious thought to installing solar panels is down 7 percentage points from 2019.

Residential solar by region

In the January survey, homeowners in Western states were especially likely to have considered or already installed solar panels at their homes, as past Center surveys have also found. Among homeowners in the Pacific region, 45% say they’ve given serious thought to installing solar panels to generate electricity for their home, while another 17% say they’ve already done this. About half of homeowners in the Mountain region (51%) also say they have either given serious thought to installing or already installed solar panels.

The survey is consistent with EIA data, which shows that California has by far the greatest electricity-generating capacity from small-scale residential solar power. Arizona and Texas are next in electricity-generating capacity from residential solar power.

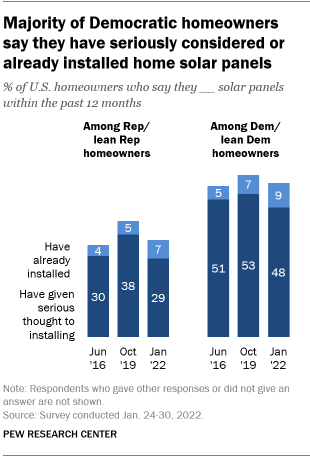

Interest in home solar panels differs by party

Democratic and Democratic-leaning homeowners are more likely than Republican and GOP-leaning homeowners to say they’ve installed or given serious thought in the past year to installing solar panels at their home to generate electricity (57% vs. 36%), according to the January survey. Past Center surveys have also found that Democrats are more likely than Republicans to say they have already installed or given serious thought to installing solar panels.

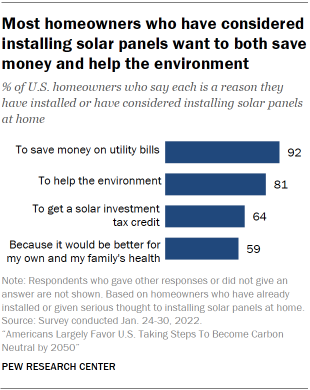

When asked about possible reasons for installing solar panels, almost all homeowners who have installed them or considered doing so (92%) see saving money on bills as a reason. Democrats and Republicans who have installed or considered installing home solar panels are about equally likely to say this.

Most homeowners who said in January that they’ve installed or seriously considered installing solar panels at home said helping the environment was a motivation for doing so (81%). About six-in-ten (59%) said they did so because it would be better for their health and their family’s health. Another 64% cited solar investment tax credits as a reason.

The federal tax credit for home solar panels was 26% of the installation costs prior to the recent law, which increased that percentage to 30% through 2032. Many states give additional tax credits for installing solar panels.

Note: Here are the questions used for this analysis, along with responses, and its methodology.