Americans owed about $1.5 trillion in student loans at the end of March 2019, more than two times what they owed a decade earlier. The increase has come as historically high shares of young adults in the United States go to college and the cost of higher education increases.

Here are five facts about student loans in America, based on a Pew Research Center analysis of recently released data from the Federal Reserve Board’s 2018 Survey of Household Economics and Decisionmaking:

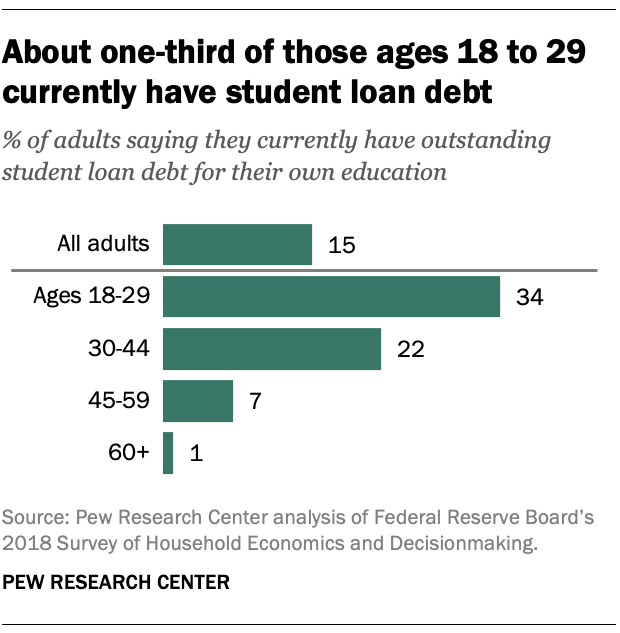

1 About one-third of adults under age 30 have student loan debt. Among adults ages 18 to 29, 34% say they have outstanding student loans for their own education. (This includes those with loans currently in deferment or forbearance, but excludes credit card debt and home and other loans taken out for education.) Looking only at young adults with a bachelor’s degree or more education, the share with outstanding student debt rises to 49%.

About one-third of adults under age 30 have student loan debt. Among adults ages 18 to 29, 34% say they have outstanding student loans for their own education. (This includes those with loans currently in deferment or forbearance, but excludes credit card debt and home and other loans taken out for education.) Looking only at young adults with a bachelor’s degree or more education, the share with outstanding student debt rises to 49%.

Student debt is less common among older age groups. Roughly one-in-five adults ages 30 to 44 (22%) have student loan debt, as do 4% of those 45 and older.

While age differences may partly reflect the fact that older adults have had more time to repay their loans, other research has found that young adults are also more likely now than in the past to take out loans to pay for their education. About six-in-ten college seniors ages 18 to 24 took out loans for their education in the 2015-2016 school year, up from about half in the 1999-2000 school year, according to the National Center for Education Statistics.

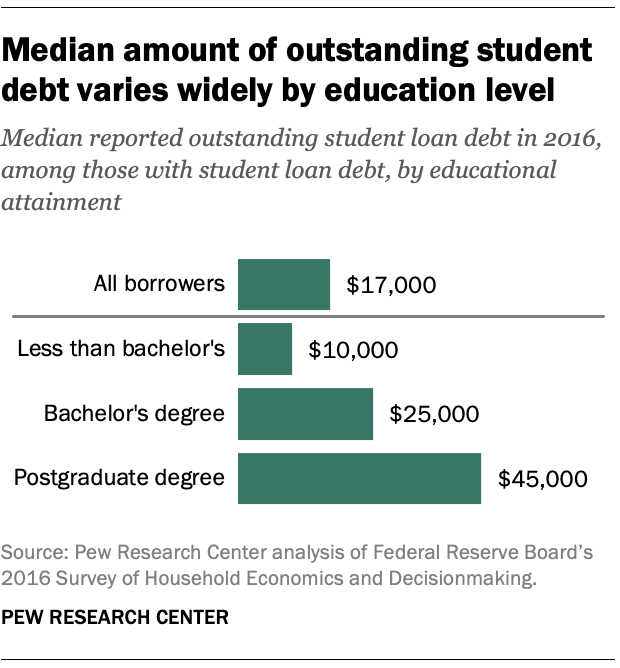

2 In 2016, the amount students owed varied widely, especially by degree attained. The median borrower with outstanding student loan debt for their own education owed $17,000 in 2016. The amount owed varied considerably, however. A quarter of borrowers with outstanding debt reported owing $7,000 or less, while another quarter owed $43,000 or more. (Because of changes to the survey questions, it is not possible to determine the amount owed in 2018.)

In 2016, the amount students owed varied widely, especially by degree attained. The median borrower with outstanding student loan debt for their own education owed $17,000 in 2016. The amount owed varied considerably, however. A quarter of borrowers with outstanding debt reported owing $7,000 or less, while another quarter owed $43,000 or more. (Because of changes to the survey questions, it is not possible to determine the amount owed in 2018.)

Educational attainment helps explain this variation. Among borrowers of all ages with outstanding student loan debt, the median self-reported amount owed among those with less than a bachelor’s degree was $10,000 in 2016. Bachelor’s degree holders owed a median of $25,000, while those with a postgraduate degree owed a median of $45,000.

Relatively few with student loan debt had six-figure balances in 2016. Only 7% of current borrowers had at least $100,000 in outstanding debt, which corresponds to 1% of the adult population. Balances of $100,000 or more were most common among postgraduate degree holders. Of those with a postgraduate degree and outstanding debt, 23% reported owing $100,000 or more.

3Young college graduates with student loans are more likely than those without loans to report struggling financially. Student loan holders give a more downbeat assessment of their personal financial situation compared with their peers who don’t have outstanding student debt. College graduates ages 25 to 39 with loans are more likely than graduates without loans to say they are either finding it difficult to get by financially or are just getting by (22% vs. 11%). About three-in-ten young college graduates with student loans (32%) say they are living comfortably, compared with 51% of college graduates of a similar age without outstanding loans.

4Young college graduates with student loans are more likely to live in a higher-income family than those without a bachelor’s degree. For many young adults, student loans are a way to make an otherwise unattainable education a reality. Although these students have to borrow money to attend, the investment might make sense if it leads to higher earnings later in life.

On average, those ages 25 to 39 with at least a bachelor’s degree and outstanding student debt have higher family incomes – the individual’s income plus that of their spouse or partner – than those in this age range lacking a bachelor’s degree (regardless of loan status). About half of young college graduates with student loans (52%) live in families earning at least $75,000, compared with 18% of those without a bachelor’s degree. However, they are still less likely to earn this level of family income than young college graduates without outstanding student loans (64%). (Family income reflects more than just an individual’s personal returns from higher education, including the fact that college graduates are more likely to marry.)

About half of young adults without a bachelor’s degree (53%) live in families earning less than $40,000, compared with 21% of young college graduates with student loans.

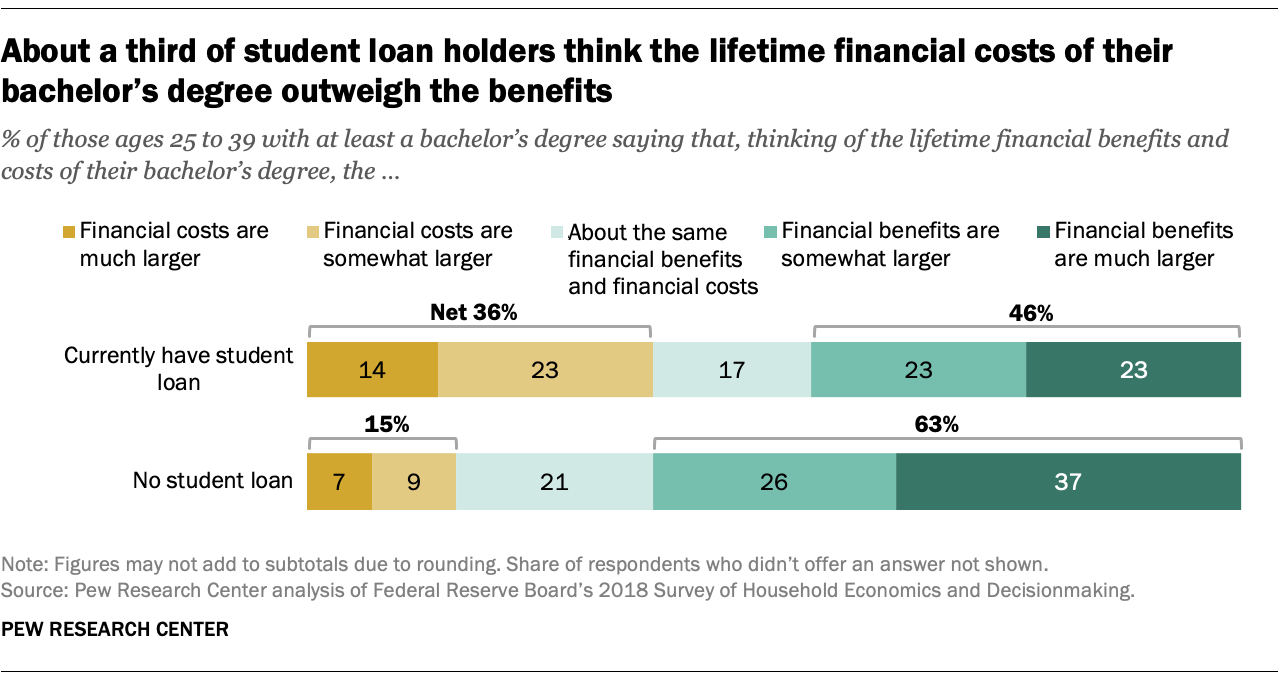

5Compared with young adults who don’t have student debt, student loan holders are less upbeat about the value of their degree. About a third (36%) of those ages 25 to 39 with at least a bachelor’s degree and outstanding student loan debt say that the lifetime financial costs of their degree outweigh the benefits. By comparison, 15% of young college graduates without outstanding student loans say the lifetime costs outweigh the benefits.

Note: This is an update of a post originally published on Aug. 24, 2017.

Note: This is an update of a post originally published on Aug. 24, 2017.