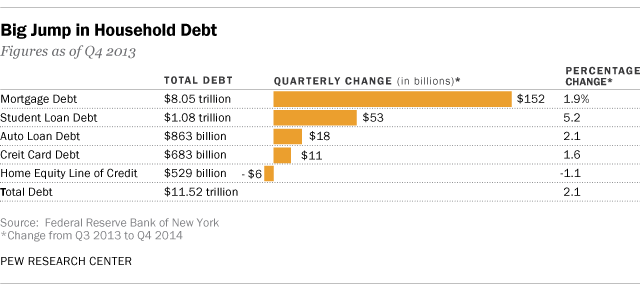

Led by an increase in mortgage borrowing, overall household debt increased by $241 billion to $11.52 trillion during the last quarter of 2013 — 2.1% higher than it had been for the previous three months, according to the Federal Reserve Bank of New York. The last time there had been that big of an increase from quarter to quarter had been in 2007.

The Fed said that, when measured against year-ago levels, it was the first time since before the Great Recession that household debt had increased, suggesting that U.S. households were borrowing again after a long period of reducing debt.

Some economists saw the new figures as another sign that a corner was being turned in the economic recovery. However, the figures — which showed much more modest growth in debt in 2013 when compared with 2006 — also suggested that consumers were now being more cautious than they were in the period before the financial meltdown when many Americans got in over their heads in mortgage and other borrowing.

Some economists saw the new figures as another sign that a corner was being turned in the economic recovery. However, the figures — which showed much more modest growth in debt in 2013 when compared with 2006 — also suggested that consumers were now being more cautious than they were in the period before the financial meltdown when many Americans got in over their heads in mortgage and other borrowing.

In contrast to the mortgage debt run up before the meltdown, most of the borrowing in this area is coming from those with high credit scores, the Fed said. Balances fell last year for the lowest-credit score borrowers who were at the core of the problem during the subprime mortgage crisis.

While increased borrowing to buy houses or cars can be seen as a positive sign for the economy, other kinds of debt — like student loan debt — can be negative, because the weight of those loans on young adults can stand in the way of their ability to afford homes or cars. The jump in student debt in the last quarter of 2013 represented the biggest percentage increase in any debt product.