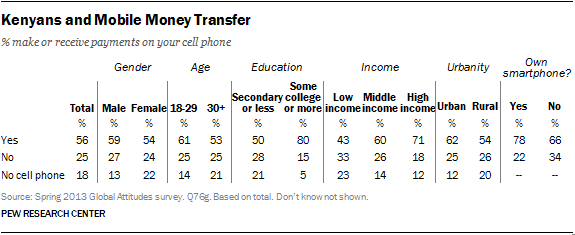

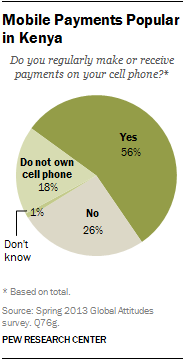

Kenya is on the forefront of a banking revolution; a majority of Kenyans (56%) make or receive payments using cell phones. The number of Kenyans engaged in this activity is higher than any of the other 24 countries surveyed in our spring 2013 survey. In fact, only in neighboring Uganda do even a plurality of people say they use their cell phones for mobile banking transactions.

Kenya’s embrace of mobile money management appears to surpass the U.S. Although we have not polled specifically about mobile payments, our most recent figures show that 35% of American cell owners do mobile banking and 61% of online Americans do banking online.

The remarkable rise of mobile money transfer in Kenya is due in part to something called the M-Pesa service, which was introduced in Kenya in 2007 by Vodaphone and its affiliate Safaricom. M-Pesa (which literally means “mobile money”) allows users to transfer payments of up to $500 from mobile phones with a small, flat, per-transaction fee. It is now estimated that 24.8 million subscribers use mobile money transfer services, like M-PESA, in Kenya. And as the World Banks notes, “the affordability of the service has been key in opening the door to formal financial services for Kenya’s poor.”