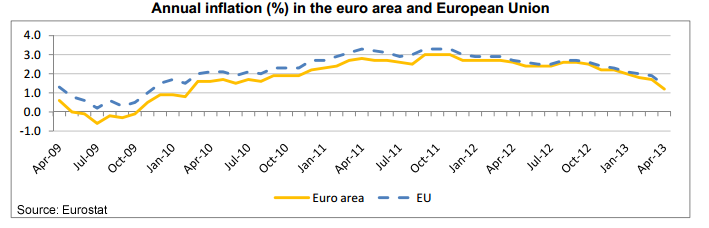

Eurostat, the European statistical agency, announced today that the European Union’s annual inflation rate in April was 1.4%, down from a rate of 2.7% in April 2012. Nonetheless, across eight EU nations surveyed by the Pew Research Center in March 2013, a median of 67% said rising prices were a “very” big problem in their countries. As the European Central Bank contemplates interest rate cuts to stimulate economic growth in a euro area now in recession, such public worry about inflation only complicates their task.

As the International Monetary Fund noted in its Spring 2013 World Economic Outlook, inflation is the dog that hasn’t barked in the wake of the Great Recession. Despite unprecedented monetary easing through various conventional and unconventional measures by both the European Central Bank and the Bank of England, prices in the European Union generally have been falling. In April, according to today’s Eurostat report, prices in Germany were rising by 1.1%, by 0.8% in France and by 1.5% in Spain.

Nevertheless, majorities in six of the eight countries see rising prices as a very big problem. The Greeks were the most worried: 94% say inflation is a major issue. But official statistics show that in March, when the survey was taken, Greek prices were actually falling at an annual rate of 0.2%; in April, according to Eurostat, consumer prices fell at a 0.6% annual rate.

Despite a national narrative widely propounded by German elites and government officials that the German psyche has been permanently scarred by the hyperinflation of the 1920s, rendering modern Germans inflation-phobic, only 31% of Germans think rising prices are a very big problem.

This relative lack of worry about inflation among Germans may be a sign that the European Central Bank, which has long been sensitive to German inflation concerns, has more room to maneuver than might otherwise have been thought, at least with the German public.