In 2013, the business of journalism saw another twist in its digital evolution: An influx of new money – and interest – from the tech world.

In 2013, the business of journalism saw another twist in its digital evolution: An influx of new money – and interest – from the tech world.

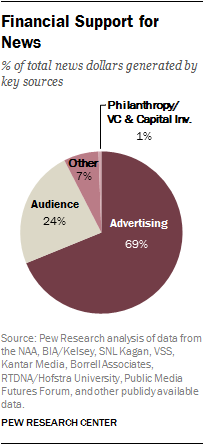

At this point, professional newsgathering is still largely supported by advertising directed to such legacy platforms as print and television and, secondarily, by audience revenues (mostly subscriptions). But other ways of paying for news are becoming more visible. Much of the momentum is around this high-profile interest from the tech world, in the form of venture capital and individual and corporate investments, which bring with them different skill sets and approaches to journalism. Philanthropy is growing, too, particularly as a source of capital for regional and investigative journalism. These newer investments—many of which are ‘unearned revenue’—do not yet represent a sea change in the business model. But they do signify a pivot in the news world. More than the sum of dollars and cents, this funding patchwork serves as a series of signposts pointing toward the ways journalism may be paid for in the years to come.

As an industry, news in the U.S. generates roughly $63 billion to $65 billion in annual revenue, according to Pew Research analysis of official filings, projections by financial firms and self-reported data.1 While admittedly an estimate, the figure provides a sense of scale: The global video game industry takes in about $93 billion a year. Starbucks reported $15 billion in 2013 revenues and Google alone generated $58 billion that year.

Much like the creative financing deals in post-recession commercial real estate, the financial support for journalism has become more complex and more varied. Just in the last year, the industry saw the viral content website BuzzFeed’s investment in original investigative and foreign reporting, Amazon founder Jeff Bezos’ purchase of The Washington Post with the promise of “runway” money to allow the newspaper to grow, Vox Media’s capital investment in Ezra Klein’s explanatory journalism project, and eBay founder Pierre Omidyar’s projected $250 million investment in the creation of First Look Media.

Much of this new investment is from people and organizations native to digital. They understand technology innately and succeeded there first, before moving into news. Much of it also comes from deep pockets that can potentially allow for some failure and loss during experimentation.

It is far too early to know whether efficiencies created by digital tools, business practices and newsgathering sensibilities will be enough to make up for the gaps left by declines in legacy resources. But, this report attempts, as best as possible, to place a wide variety of revenue streams and investments in context, providing a broad picture of the mix of financial support for professional newsgathering in the United States. While some data remains unavailable for public scrutiny, this report represents the most holistic—and up-to-date—known accounting of revenue specifically for news.

Among the findings:

- Advertising, at least for now, still accounts for the majority of known news revenue—a little over two-thirds, by this reckoning. But the advertising-supported business model is in a state of churn. Print advertising continues its sharp decline. Television advertising currently remains stable, but the steady audience migration to the web will inevitably impact that business model, too. Digital advertising is growing, though not nearly fast enough to keep pace with declines in legacy ad formats. And, while new forms of digital advertising gained momentum in 2013, the online advertising market seems to favor a scale achievable only by few.

- Audience revenue is the next largest source of income for the industry, accounting for about a quarter of the total news pie through subscriptions, cable fees and individual giving. It is growing—both as a dollar figure and as a share of the whole. But audience-driven revenue growth does not necessarily signify that more people are paying for news. Rather, the data suggest that, in aggregate, more revenue is being squeezed out of a shrinking—or at least flat—base of paying consumers.

- Personal wealth, capital investment and philanthropy are all growing, but are still a small slice of that pie. Venture capital from angel investor groups and the like has added at least $300 million over the past year to digital operations that are investing in editorial content. That venture capital, along with revenue generated with other content, allowed brands to build and expand original newsgathering operations. Foundation support for public radio, as well as scores of digital nonprofit outlets, added roughly $150 million. While not earned revenue, these different streams account for approximately 1% of all known financial support for news.

- Other earned revenue streams—such as event hosting, marketing services and web consulting, could become a critical component to the broader, long-term picture. For now, these various streams remain small, accounting for about 7% of the whole.

Have additional data on revenue supporting news? Please share it with us to help inform the research.

The job of piecing together the dollars currently supporting U.S. journalism is a complicated one. The revenues analyzed here include earned revenue from advertising (both legacy and digital), audience payments, smaller streams like events, marketing services and content licensing or syndication, as well as financial support from philanthropic organizations, individuals and private capital. More difficult to account for are capital investments from companies, many of them technology firms, into original newsgathering under their own roof. Researchers collected solid revenue information where available and sought out estimates when necessary, although in some cases even estimates were not offered by these companies. For many segments, the latest available year-end data come from 2012. Where possible we have included year-end 2013 figures.

The sources of data include research firms, trade associations and news organizations themselves. Some media sectors, particularly legacy and institutional ones such as newspapers and cable TV, offer more detailed data going many years back. In other sectors, like print magazines and local TV, long-standing accounting practices make it difficult to separate out news revenues from broader corporate figures, but we have done our best to do so here. And the arena of news reporting native to the digital space—whose contours continue to evolve—offers little in the way of tidy economic data, especially within digital companies where journalism is but one part of a broader content portfolio. Data from these sources often came via publicly available third-party estimates and self-reported figures found in published news reports. Not included in this accounting are digital technology firms like Google and Facebook that have become deeply entwined in the distribution of news, but do not produce their own original, professional reporting. And given this report’s focus on the general news audience, custom information platforms and the specialty subscription publications such as Bloomberg or Crain’s were not studied here.

This is a report on the shifting balance of American news revenue. Past editions of the State of the News Media included deep analysis of how individual media sectors fund their operations. All of that data are still available in our Media Database. But as the convergence of platforms accelerates, it has become increasingly clear that certain economic trends are not isolated to television, print or radio. And where there are differences, those differences are instructive.