U.S. Lags behind

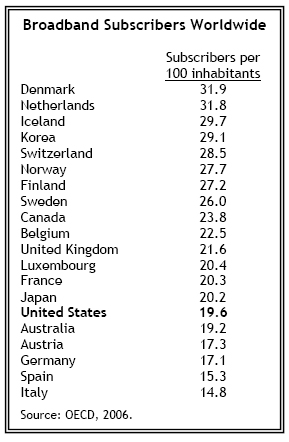

The ritual is familiar to those who follow communications policy: Every six months, the Organization for Economic Cooperation and Development (OECD) releases its rankings of per capita broadband adoption rates. Every six months, the United States sees its ranking uncomfortably in the middle of the pack. Then the clamor begins in earnest. Many decry the fact that our rankings are lower than they were just a few years ago, down to 15 in 2006 from number 4 in 2001.1 Others criticize the way the OECD puts together the rankings. Some quarters call for a national broadband strategy so that the United States can recapture its leadership position and others argue that any government-led strategy would do more harm in the marketplace than good.

Rankings-driven policy discussion might be helpful to a point, but the tenor of the current debate obscures two critical questions: What is the nature of unmet demand for broadband in the United States? And, secondarily, is home broadband adoption proceeding more slowly in the United States relative to consumer technologies of the past?

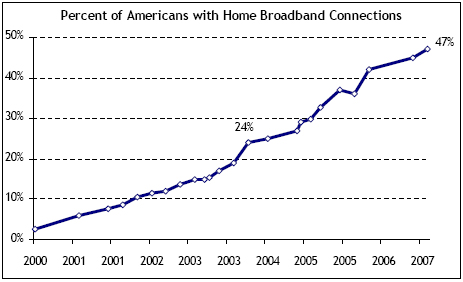

With respect to the rate of home broadband adoption, a lot has been accomplished in a relatively short time. According to the Pew Internet Project’s February 2007 survey, 47% of American adults have broadband at home, nearly double the 24% penetration level of three years earlier. With home broadband penetration poised to surpass 50% this year, it will have taken 9 years from the time the service became widely available for home high-speed to reach half the population. To put this in context, it took 10 years for the compact disc player to reach 50% of consumers, 15 years for cell phones, and 18 years for color TV. Each of those technologies, like broadband, represented an upgrade from a good or service with which most consumers had experience.

The nature of unmet demand has several dimensions. There are two large segments of the population without broadband: those who are not internet users, and those who have home internet access, but use dial-up connections. Some 29% of Americans do not use the internet, and 15% have dial-up internet access from home.2

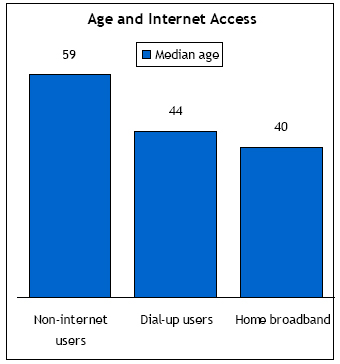

Non-internet users as a group are disproportionately old and poor. The median age of non-internet users is 59, and 25% report having household incomes under $20,000 per year. It is not, however, simply a question of money or age. Non-internet users do not have very positive attitudes about information technology. Many report worries about information overload and few link information technology to greater control over their lives. Moreover, non-internet users are apt to see the online environment as a dangerous place – that is, a place with inappropriate or irrelevant content. Given that these non-users are people with worries about information technology and not a lot of extra disposable income, luring them online won’t be an easy task.

On the other hand, it should be easier to entice the 15% of dial-up users into the ranks of home broadband subscribers. In surveys conducted in 2002, 2004, and 2006 some 40% of dial-up users told us they would like to switch to broadband, which means that 60% are content to stick with dial-up. This steady 40-60 ratio, which has held steady even as broadband penetration tripled, means that some dial-up users change their preferences. As online experience draws them more deeply into internet use, the dial-up wait becomes frustrating, users hunger for more speed, and some make the switch to broadband. But this process takes time. It is also worth noting that 29% of dial-up users have high-speed access in the workplace, suggesting that, for some, workplace broadband may substitute for a home connection.

The usability and relevance of the internet are additional speed bumps for dial-up users. Approximately one-quarter of American adults frequently need help from others to get information and communication technology (ICT) to work. Fully 43% of adult Americans say ICTs have not improved their personal productivity. Sizable numbers of Americans say ICTs either give them less control over their lives, or make no difference. The vast majority of these Americans are dial-up internet users, and their indifferent posture toward ICTs may make them reluctant to incur the costs of upgrading to broadband at home.

So, if you are in your 50’s, have limited disposable income, find modern gadgetry hard to use and of questionable relevance, what is going to turn you into a home broadband subscriber? Two frequently suggested strategies—reducing prices and improving infrastructure availability—are likely to have limited impacts. Most research on broadband adoption suggests price is not a large factor in the purchasing decision. When asked in Pew Internet Project surveys why they made the switch to broadband, most users cite the desire for more speed; few (4%) say the price had fallen to a level that made it affordable or that a discount offer prompted the switch.3 Detailed modeling of adoption behavior by Ken Flamm and Anindya Chaudhuri at the University of Texas concludes that “demand is relatively inelastic” for broadband service.4 That is, although they find a statistically significant relationship between a decline in broadband prices and growth in subscribership, it is not a very large one.

Improving infrastructure availability will help, especially in rural areas, but not by enough to alter the U.S. position in the world. When the Pew Internet Project asked dial-up users in 2004 whether broadband was available where they live, 15% said it was not available, a figure that stood at 27% for rural Americans. Those numbers might be lower in 2007, but there is a dearth of reliable nationwide information on where broadband is unavailable. Assuming most of the gap is concentrated in rural areas and that closing the gap would bring rural broadband penetration in line with the national average, America’s home broadband penetration would rise by only 3 percentage points. That will not vault the U.S. to the top of OECD’s rankings.

What, then, could policymakers do? One answer is to renew focus on demand-side stimulation targeted at hard-to-reach populations. This approach was popular in the late 1990s, but public-sector ventures into this area have received inconsistent support. The Technology Opportunities Program in the U.S. Department of Commerce, which provided partial funding for state and local projects to reach under-served populations, was discontinued early in 2003. State and local programs in this area were deemed expendable, as rates of internet adoption remained brisk and public sector resources became constrained. Some of the holes left by the demise of these programs have been filled by the non-profit sector, with initiatives such as One Economy (http://www.one-economy.com/) and on-going programs in the nation’s public libraries. But it is an open question as to whether these, and other programs, are adequate to meet the demands of under-served populations.

The passage of time has taken care of a portion of the gap in broadband adoption. The passage of time may well take care of the rest, but the likely time horizon will test the patience of many stakeholders in the broadband debate. To be sure, more competition, lower prices, and greater availability of faster infrastructure will be welcomed by American consumers. By themselves, however, they are not likely to be enough to lure non-online users off the digital sidelines. Pew Internet Project research makes it clear that non-users don’t yet see the benefits of home high-speed access. To reach the underserved, policymakers might consider more aggressive and targeted outreach efforts that educate hard-to-reach populations about the benefits of online connectivity.