Holidays online

In the early winter of 2002 the tracking survey of the Pew Internet & American Life Project showed that 57% of U.S. adults use the Internet – that comes to about 109 million people. Of those Internet users, more than 66 million have purchased a product or service online at some point in their Internet experience – not necessarily for gift-giving or holiday purchases. This represents a 10% increase in the number of online consumers from the holiday season in 2001 and is further indication that as Internet users gain more experience, confidence, and trust in the e-commerce environment they are willing to spend their money on Internet-based purchases.

While the growth of the number of Americans participating in e-commerce is notable, it is also important to put e-commerce in perspective. Simply stated, the overall volume of online sales is very small compared to the overall retail trade in America. The overall U.S. retail economy was $3.5 trillion in 2001 (the year for which the most recent data are available from the National Retail Federation based on U.S. Census figures. The best estimate for online consumer spending for 2002 was $74 billion, according to analysis by the Web monitoring firm comScore Networks – or just over 2% of the overall U.S. retail trade. Of that volume, comScore says that $43 billion is retail sales unrelated to travel purchases.

The National Retail Federation estimated that during the holiday season this year, about $209.3 billion worth of retail business would be transacted throughout the U.S. economy. Our estimate of the total volume of online shopping by Americans falls close to $11 billion and other projections put the volume at $8 billion measured by BizRate.com, the e-commerce research firm, $13.1 billion by online market research firm Jupiter Research, and $13.8 billion measured by comScore Networks. That means that holiday shopping online probably amounted to less than 1% of total holiday sales.

Holiday shopping online

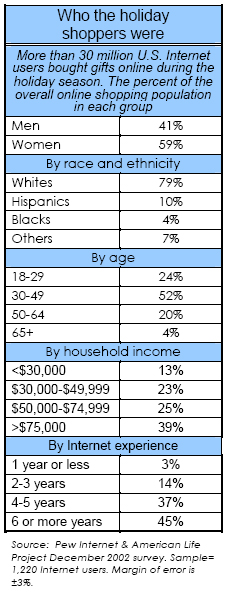

More than 30 million Americans bought gifts online (28% of Internet users). That compares to about 29 million who bought last year and 20 million who bought gifts during the holiday season in 2000. The composition of the online gift shopping population did not change much from 2001 to 2002. Women outnumbered men in most dimensions of online commerce. There were more women buying gifts than men and more women using the Internet to look for gifts and comparing prices.

Those with high levels of Internet experience were more likely to buy gifts online than those with relatively little time online. And those with broadband connections were a third more likely to purchase gifts online than those with dialup connections.

About a fifth of those online gift purchasers were newcomers to the Internet gift-buying experience. These new shoppers tended to be newcomers to the Internet – many have less than two years experience online. Other than that, they showed no special demographic characteristics. In other words, the newcomers were about equally divided between men and women, and had no striking income or educational or racial profile.

In the overall e-commerce universe – not just the holiday shopping universe – it is still the case that men slightly outnumber women. But on any given day, equal numbers of men and women are buying products via the Internet.

What e-shoppers spent

According to our survey, online holiday shoppers spent an average of $407 online in 2002, up a bit from $392 in 2001, and up from the $330 spent by the average gift shopper in 2000. The biggest increase came in those who said they had spent more than $300 online for gifts. In 2000, 34% of the estimated 20 million online holiday shoppers spent that much online. Last year 38% of the estimated 28 million online shoppers spent that much in their Internet gift purchases. This year, 43% of online shoppers spent that much in their Internet gift purchases.

To put those figures in a broader context, it is interesting to note that the National Retail Federation estimated that average spending on holiday gifts was likely to be about $650 per person this year, compared to $632 in 2001.

What e-shoppers bought: comScore Networks findings

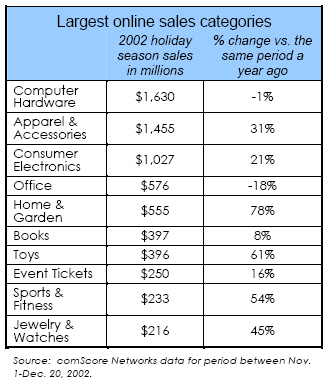

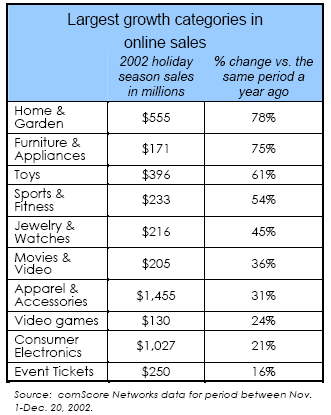

Data from comScore Networks show that Computer Hardware was the largest merchandise category based on dollar sales for the period from Nov. 1 through Dec. 20. However, mirroring the overall softness of the tech sector, sales of Computer Hardware decreased 1% versus a year-ago to $1.6 billion. Apparel and Accessories continued its recent impressive performance and was the second largest category with sales of $1.5 billion and growth of 31%. Consumer Electronics was the third largest category, with sales of $1.0 billion, up 21% versus year ago.

For the period from Nov. 1 through Dec. 20, Home and Garden ranks as the fastest growing major merchandise category, increasing 78% over last year to $555 million. Furniture and Appliances increased 75% to $171 million, while Toys increased 61% to $396 million.

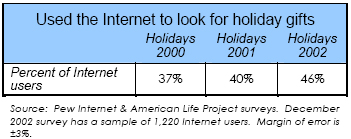

An uptick in online window shopping

The holiday season survey by the Pew Internet & American Life Project shows that 46% of online Americans used the Internet to look for gifts this year. That is almost 49 million people and represents some growth from previous years in the proportion of Internet users doing some gift research online. One of the more notable findings is that Hispanics with Internet access were particularly interested in looking for gift ideas, pricing and product information on the Web. As is invariably the case, the Internet users in higher socioeconomic groups and those with lots of Internet experience were among the most fervent window shoppers online. Broadband users were almost 50% more likely to do online window shopping as dialup users: 60% of those with high speed connections looked for gifts online, compared to 41% of those with dialup connections.

This increased use of the Internet for product research flows from a larger trend. Fully 83% of U.S. Internet users have gone online to research a product at one time or another – a marked increase from the last time we asked this question in mid-2000 when 73% of the Internet population had performed some kind of product research online.

The appeal of online price and product comparisons is easy to understand and most Americans (Internet users and non-users alike) have high expectations they can get useful information about products and services online. In one recent Pew Internet & American Life Project survey, 79% of Internet users said they would expect to find information online about the products they were interested in buying from stores. Virtually all of those who have actually done product research say they always or “most of the time” find the information they are seeking.

E-shoppers crave convenience and time savings

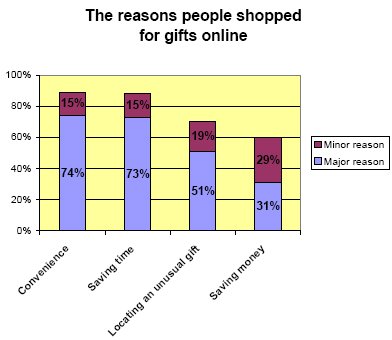

The convenience of shopping on the Internet and the prospect for saving time are the biggest draws for holiday-season e-commerce. Three-quarters of this year’s holiday shoppers said that convenience and saving time were major reasons for their making purchases online; 51% said that locating an unusual or hard-to-find gift was a major reason; and 31% said saving money was a major reason.

Some of the demographic highlights: Online whites and Hispanics were among the most likely to cite the convenience of online gift buying as a major reason for their shopping. In addition, those who bought relatively large numbers of gifts online cited the convenience of this mode of shopping as a key issue. African-Americans with Internet access were particularly attracted to online gift-buying by the prospect of saving money, as were those who did most of their online buying early in the shopping cycle in the first weeks of December. Finally, those who spent the largest sums on gift purchases online were also those anxious to save time.

Six percent of Internet users wanted to help their loved ones with their shopping: These users created online “wish lists.”

Where they logged on: One third shop online at work

Some 90% of holiday shoppers said they did some online gift purchases from their homes, a figure that is slightly smaller than the percentage of online shoppers who logged on from home last year. A third of wired holiday shoppers made gift purchases from their work stations at the office, a figure that is slightly up from last year when 31% of holiday shoppers bought gifts while using the Internet from work.

Young Internet users were more likely than their elders to buy gifts while they were at work. Some 42% of those under age 30 who bought gifts this season did so from work, compared to 22% of those over age 50. And many Internet veterans had few qualms about using work computers to do online shopping: 37% of those with over six years of Internet experience who bought gifts online did so from work, compared to 6% of those who had less than a year’s experience.

Online auction activity is up

In all, our December survey shows that 24 million American Internet users (22% of the online population) have participated in online auctions at one time or another. That compares to 15% of Internet users (or about 14 million people) who had participated in online auctions in the summer of 2000, when we asked the same question. Online men and those under age 50 are driving the trend, as is Internet experience – 29% of those who have been online for six years or more have participated in online auctions. In addition, parents with Internet access are notably more likely to participate in auctions than non-parents.

What is even more striking is that the number of daily auction participants has more than doubled since mid-2000. In December 2002, about 4.5 million U.S. Internet users were involved in auctions on any given day. In June 2000, fewer than 2 million Internet users were participating in online auctions.