The persistence and depth of the European economic downturn triggered by the euro crisis has had a profoundly adverse impact on most Europeans’ attitudes toward the condition of their national economies. People are almost universally dissatisfied with the state of their nations. Only the Germans are satisfied with the direction of their country and the state of their national economy. Europeans blame the banks and their own governments for their troubles. And none, not even the Germans, expect conditions to improve over the next year. Asked about their economic worries, Europeans are especially concerned about joblessness, public debt and inflation.

Widespread Dissatisfaction

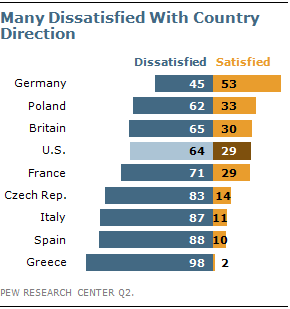

In the fourth year of the global financial crisis, there is widespread public dissatisfaction in seven of the eight European nations surveyed. Just a small fraction of Europeans are happy with the direction of their nation. Only in Germany (53%) is more than half the population content with national conditions. The mood is particularly grim in Greece, where just 2% of Greeks are satisfied.

In the fourth year of the global financial crisis, there is widespread public dissatisfaction in seven of the eight European nations surveyed. Just a small fraction of Europeans are happy with the direction of their nation. Only in Germany (53%) is more than half the population content with national conditions. The mood is particularly grim in Greece, where just 2% of Greeks are satisfied.

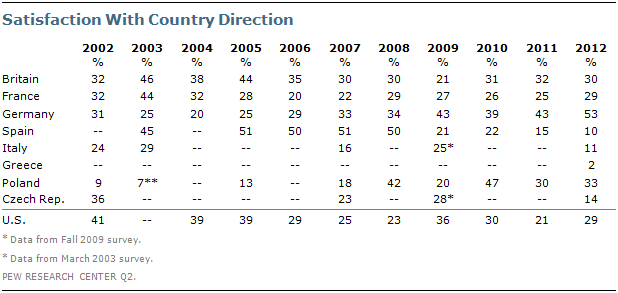

There is, however, not much change in national sentiment from last year in five countries where there is comparable data. Sentiment is roughly unchanged in Britain, Poland, Spain and France. Only in Germany have assessments improved significantly, from 43% in 2011 to 53% in 2012.

Compared with 2007, before the crisis hit, national satisfaction today is down by 41 points in Spain and nine points in the Czech Republic. At the same time, it is up 20 points in Germany (from 33% to 53%), up 15 points in Poland (from 18% to 33%) and up seven points in France (from 22% to 29%).

National dissatisfaction is a shared transatlantic phenomenon. Only 29% of Americans are satisfied with the way things are going in their country. That figure is up eight points from 2011.

Economic Gloom

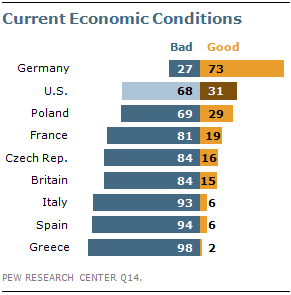

National discontent is rooted in an extremely gloomy assessment of local economic conditions, especially in southern Europe. Only 2% of the Greeks and 6% of the Italians and Spanish describe the current economic situation in their countries as good. But economic perceptions are not that much better in most of northern or eastern Europe. Only 15% of the British, 16% of the Czechs, 19% of the French and 29% of the Poles say their economy is doing well.

National discontent is rooted in an extremely gloomy assessment of local economic conditions, especially in southern Europe. Only 2% of the Greeks and 6% of the Italians and Spanish describe the current economic situation in their countries as good. But economic perceptions are not that much better in most of northern or eastern Europe. Only 15% of the British, 16% of the Czechs, 19% of the French and 29% of the Poles say their economy is doing well.

And economic despair is profound. An overwhelming 78% of the Greeks and 72% of the Spanish think their national economic performance is “very bad,” as do 56% of Italians. And that strongly negative Italian assessment has increased 28 percentage points since the fall of 2009.

In most countries, the public’s economic assessment has declined since 2007, before the economic crisis began, although a majority of the French, Italians and Czechs have never been satisfied with their economies since Pew began surveying in 2002. In Germany and Poland, on the other hand, public economic sentiment has been on a roller coaster ride, with wide mood swings, often from one year to the next, for the last decade. At the moment, the Germans could not be more pleased about economic conditions. Nearly three-quarters (73%) say their economy is good, up 45 points from the spring of 2009.

In most countries, the public’s economic assessment has declined since 2007, before the economic crisis began, although a majority of the French, Italians and Czechs have never been satisfied with their economies since Pew began surveying in 2002. In Germany and Poland, on the other hand, public economic sentiment has been on a roller coaster ride, with wide mood swings, often from one year to the next, for the last decade. At the moment, the Germans could not be more pleased about economic conditions. Nearly three-quarters (73%) say their economy is good, up 45 points from the spring of 2009.

By comparison, while less than a third (31%) of Americans say economic conditions are good, that is up 13 points from last year. That economic assessment, while anemic, is still better than that in most European countries surveyed. It is, however, far less than the half of Americans who were satisfied with the economy in 2007, before the Wall Street debacle.

Personal Finances Deteriorating

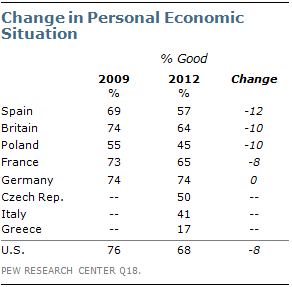

Europeans generally say that their personal economic situation is much better than their perception of their own national economic conditions. But even that more positive assessment has deteriorated sharply since 2009 in many countries. Half or more of those in five of the eight nations surveyed say their economic condition is good, including Germany (74%), France (65%) and Britain (64%). But that sentiment is down 12 percentage points in Spain, 10 points in Britain and Poland and eight points in France since 2009. Personal economic assessments are unchanged in Germany.

Europeans generally say that their personal economic situation is much better than their perception of their own national economic conditions. But even that more positive assessment has deteriorated sharply since 2009 in many countries. Half or more of those in five of the eight nations surveyed say their economic condition is good, including Germany (74%), France (65%) and Britain (64%). But that sentiment is down 12 percentage points in Spain, 10 points in Britain and Poland and eight points in France since 2009. Personal economic assessments are unchanged in Germany.

Like their European counterparts, Americans feel better about their own finances than about the condition of the U.S. economy, although the percentage of Americans describing their personal economic circumstances as good has slipped from 76% in 2009 to 68% today.

Europeans are less sanguine about how their current personal finances stack up against how they and their families were doing five years ago. A majority of the Greeks (81%) and the Spanish (60%) feel they are doing worse off. And a plurality of the French, Italians, British, Czechs and Poles agree. The Germans say their family finances are about the same as five years ago. Nearly four-in-ten Americans (38%) say their situation is about the same, while 34% say it is worse and 27% describe their current financial situation as better.

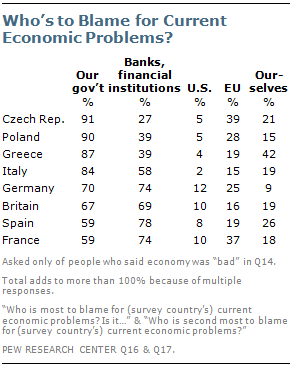

Blame the Banks and the Government

Europeans’ assessment of their economies’ performance varies, as does who they blame for current economic conditions. Among those who say their economy is bad, people in four countries – the Czech Republic (91%), Poland (90%), Greece (87%) and Italy (84%) – overwhelmingly say their own governments are responsible for current economic problems. In two other European nations, Spain (78%) and France (74%), people put the onus on the banks and other major financial institutions. And in two countries, opinion is more divided: Britain (69% fault the banks, 67% blame their government) and Germany (74% blame banks, 70% fault the government).

Europeans’ assessment of their economies’ performance varies, as does who they blame for current economic conditions. Among those who say their economy is bad, people in four countries – the Czech Republic (91%), Poland (90%), Greece (87%) and Italy (84%) – overwhelmingly say their own governments are responsible for current economic problems. In two other European nations, Spain (78%) and France (74%), people put the onus on the banks and other major financial institutions. And in two countries, opinion is more divided: Britain (69% fault the banks, 67% blame their government) and Germany (74% blame banks, 70% fault the government).

In Britain, France, Germany and Spain, people ages 18-29 are especially likely to blame their own government. In Britain, France and Spain the people most judgmental of financial institutions are those 50 years of age and older.

Public assessments of the state of the nation, the economy and who is to blame often are rooted in a person’s politics and can divide along ideological lines. In Britain, France and the Czech Republic, countries with center-right governments when the survey was taken, people on the left are more dissatisfied with national conditions and the state of the economy than those on the right. In Greece, Spain and Italy, unhappiness with the national state of affairs and the economy is so profound that it transcends political leanings.

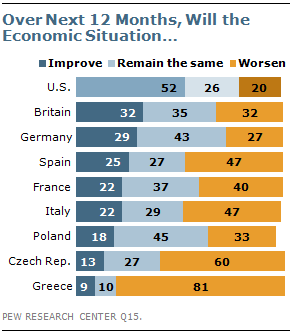

Pessimism About the Future

Looking forward, Europeans are uniformly downbeat about the future. Only 9% of the Greeks, 13% of the Czechs and 18% of the Poles expect the economic situation to improve over the next 12 months. Economic optimism is not much more widespread in France (22%), Italy (22%), Spain (25%) or Germany (29%). An overwhelming majority (81%) of Greeks actually expect the economy to worsen, including 53% who say it will worsen a lot. A majority of the Czechs (60%) and a plurality of the Spanish (47%) and the Italians (47%) also see things going downhill. Views about the future of the economy are relatively unchanged in most of Europe since 2011. But notably they are down nine points in Germany from last year.

Looking forward, Europeans are uniformly downbeat about the future. Only 9% of the Greeks, 13% of the Czechs and 18% of the Poles expect the economic situation to improve over the next 12 months. Economic optimism is not much more widespread in France (22%), Italy (22%), Spain (25%) or Germany (29%). An overwhelming majority (81%) of Greeks actually expect the economy to worsen, including 53% who say it will worsen a lot. A majority of the Czechs (60%) and a plurality of the Spanish (47%) and the Italians (47%) also see things going downhill. Views about the future of the economy are relatively unchanged in most of Europe since 2011. But notably they are down nine points in Germany from last year.

Current American optimism about the economy clashes sharply with European pessimism. Roughly half (52%) of all Americans see the U.S. economy getting better over the next year, up 10 percentage points from 2011.

On a more personal level, Europeans are similarly gloomy about potential economic mobility for their children. Strong majorities of the Greeks (73%), the Spanish (69%) and the Italians (62%) think it will be very difficult for a young person in their country to get a better job and to become wealthier than his or her parents. Americans generally share Europeans’ pessimism for their children, although less intensely.

On a more personal level, Europeans are similarly gloomy about potential economic mobility for their children. Strong majorities of the Greeks (73%), the Spanish (69%) and the Italians (62%) think it will be very difficult for a young person in their country to get a better job and to become wealthier than his or her parents. Americans generally share Europeans’ pessimism for their children, although less intensely.

Nevertheless, this pessimism should be seen in context. Compared with their parents at their same age, majorities in most European countries think that their own standard of living is better than that of the previous generation. This includes 71% of the Spanish, 70% of the Germans and even 57% of the Greeks. Among the countries surveyed, only the French (48%) are not sure they live better than their parents. Six-in-ten Americans say they are better off than their elders, a total roughly comparable to the European median (59%).

Shared Economic Troubles

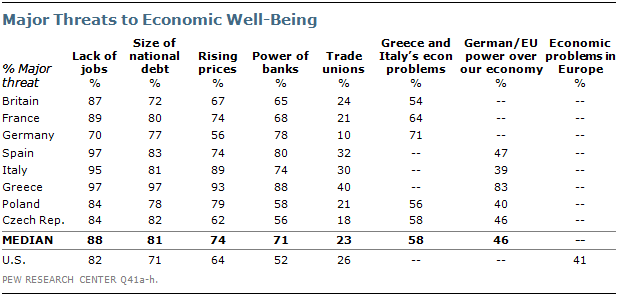

Troubled about their economies and their economic future, Europeans fret in overwhelming numbers about the three horsemen of economic anxiety: unemployment, debt, and inflation, as well as the power of the banks, but not trade unions.

Overall, Europeans are most worried that the lack of jobs poses a major threat to their national economic well-being, with concern the highest in Spain (97%), Greece (97%) and Italy (95%). Only in Germany does apprehension over the size of the national debt (77%) trump the fear of joblessness (70%). Debt is generally the second most troubling economic issue. In most countries, women are especially worried about public indebtedness.

Inflation fears outstrip debt worries in Italy and run neck and neck in Poland. In Germany, the Czech Republic, and France, the less educated are generally more concerned about rising prices than the more educated. Despite their national trauma with hyperinflation in the 1920s, Germans (56%) are less likely than the other Europeans surveyed to worry about rising prices.

The Greeks, with the worst performing economy in Europe, are overwhelmingly worried about all these threats to their well-being.

Americans share these European concerns. And they agree that a lack of jobs is a greater threat than public debt or inflation. But Americans are less likely to be worried about each of these issues than are the Europeans. Roughly seven-in-ten Americans (71%) fret about the size of the national debt. The percentage of Europeans who share this concern is even higher. Nearly two-thirds of Americans (64%) fear inflation; again, the concern in all but two of the European countries surveyed is higher. But unease about the national debt is far more likely to be a partisan issue in the United States than it is in Europe. Europeans, whatever their political leanings, tend to see indebtedness the same way. The left-right divide in concern is five percentage points in Germany, four in France, and three in Britain. It is 20 points in the United States, with only 59% of liberals ranking debt as a major threat to the economy compared with 79% of conservatives.

Structural Threats to Economic Well-Being

Among institutional and structural threats to national economic well-being, Europeans are more than three times as likely to worry about the power of banks and financial institutions as they are to be concerned about the power of trade unions. The Greeks (88%) are the most concerned about the power of the banks, as well as the influence of labor unions (40%). Notably, Americans are generally less likely than Europeans to think financial institutions imperil national economic well-being. Twice as many people in the United States are concerned about the influence of the banks as fret about the power of unions.

At a time of economic turmoil and anxiety throughout Europe, northern Europeans are less likely to acknowledge their economic interconnectedness than are southern and eastern Europeans. Majorities in France (60%), Germany (57%) and Britain (55%) say what happens in other European Union countries does not affect their own personal well-being. Half or more in Greece (82%), the Czech Republic (60%), Poland (55%), Italy (51%) and Spain (50%) think their personal fortunes are inextricably linked to developments elsewhere.

But, when asked about specific external economic threats, majorities in northern and eastern Europe think the economic woes of countries like Greece and Italy pose a major risk to the economic fortunes of their countries. This concern is especially strong in Germany (71%). And conservatives in France are more likely than those on the left to harbor such qualms.

Meanwhile, Greeks overwhelmingly believe the power of Germany and other EU nations seriously endangers their economic welfare – 83% say this is a major threat. Less than half, however, in Spain (47%), the Czech Republic (46%), Poland (40%) and Italy (39%) hold this view.

Fears of European economic turmoil have yet to cross the Atlantic. Only 41% of Americans think the economic problems in Europe pose a major threat to the U.S. economy.

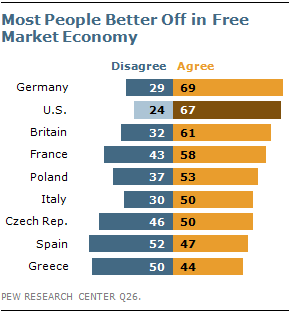

Free Market Support Failing

One casualty of the euro crisis has been support for capitalism in Europe, especially in some countries most adversely impacted by the economic downturn. Around half the population in Spain (52%) and Greece (50%) do not believe that people are better off in a free market economy. And since 2007, before the global financial downturn, support for the free market system has fallen by 23 points in Italy, 20 points in Spain and nine points in the Czech Republic. But belief in capitalism has also fallen 15 points in Poland over that time period, when the Polish economy was doing relatively well.

One casualty of the euro crisis has been support for capitalism in Europe, especially in some countries most adversely impacted by the economic downturn. Around half the population in Spain (52%) and Greece (50%) do not believe that people are better off in a free market economy. And since 2007, before the global financial downturn, support for the free market system has fallen by 23 points in Italy, 20 points in Spain and nine points in the Czech Republic. But belief in capitalism has also fallen 15 points in Poland over that time period, when the Polish economy was doing relatively well.

Majorities in Germany (69%), Britain (61%) and France (58%) still believe that most people are better off in a free market economy, even though some people are rich and some are poor. Europeans with a college education are generally favorable toward capitalism. Men are generally more supportive than women. In Britain, France, the Czech Republic and Greece, those on the political right have a more positive view of free markets than do those on the left.