The stock markets have been on a tear this year, epitomized today by both the Dow Jones industrial average and the S&P 500 index hitting round-number milestones. The Dow crossed 16,000 and is up about 22% this year; the S&P briefly popped above 1,800 and, though it’s slipped back below that level, is still up about 26% for the year. But only about half of Americans — especially those who tend to be white, wealthy and more educated — will see any benefit from surging stocks.

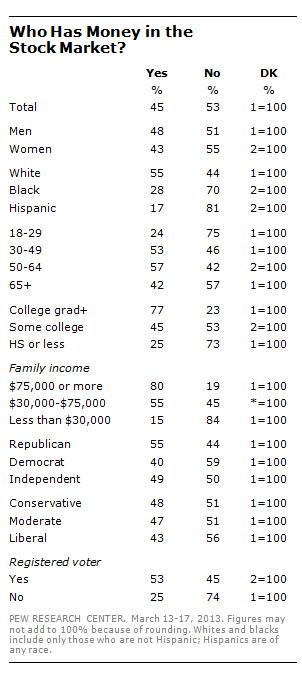

Gallup’s annual economy and finance survey, conducted in April, found 52% of Americans saying they owned stock, either directly or through a mutual fund, retirement account or other investment vehicle. The ownership share dropped sharply after the 2007-08 financial crisis and has continued falling throughout the nation’s wobbly recovery. (A Pew Research Center survey conducted in March found a somewhat lower ownership share — only 45% of Americans in that survey said they had money in the market.)

Gallup’s annual economy and finance survey, conducted in April, found 52% of Americans saying they owned stock, either directly or through a mutual fund, retirement account or other investment vehicle. The ownership share dropped sharply after the 2007-08 financial crisis and has continued falling throughout the nation’s wobbly recovery. (A Pew Research Center survey conducted in March found a somewhat lower ownership share — only 45% of Americans in that survey said they had money in the market.)

Our survey found that stock ownership was sharply differentiated by age, race and socioeconomic status: More than half (55%) of whites, for instance, said they were invested in stocks, compared with 28% of blacks and 17% of Hispanics. 77% of college graduates reported being invested in stocks (versus less than half of non-graduates), and 80% of people with incomes of $75,000 or more, compared with 55% of people with incomes of $30,000 to $75,000 and just 15% of people with incomes below $30,000.